What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

Renewables at a Crossroads: The Inflation Reduction Act and Utilities

Renewables at a Crossroads: The Inflation Reduction Act and Utilities

Sartaz Ahmed

Executive summary:

- The renewable energy sector in the United States is expanding rapidly, creating both business opportunities and challenges for utilities organizations

- The Inflation Reduction Act accelerates and transforms the renewables market while also heightening existing challenges

- To succeed and navigate these challenges, organizations must scale their operations, gain revenue certainty and utilize battery storage

The renewables sector is growing and shows no signs of slowing down. This rapid expansion presents business opportunities to reduce costs for ratepayers, promote clean energy and open new revenue streams. Yet this expansion also brings numerous challenges that businesses must navigate, and recent policy changes have only exacerbated these challenges.

In the United States, the Inflation Reduction Act (IRA) is arguably the most impactful energy legislation in the country’s history. By uncapping and making perpetual the tax credit for renewables, the IRA gives federal support to the renewables sector, and the monetary value of that support will likely far surpass the approximately $400 billion that many analysts have cited. But great opportunities bring great challenges for utilities, who must ensure accelerated growth does not come at the expense of reliability.

What particular challenges do developers and utilities face, and how can industry participants navigate these challenges as the IRA accelerates the growth of the renewables market?

What pre-existing challenges do utilities face?

Even prior to the IRA, federal and state governments in the U.S. have driven business by sponsoring energy legislation. In 2018, for example, California passed Senate Bill 100, which aims to power the state exclusively with clean energy by 2045. Additionally, incentive programs across the U.S. have increased electric vehicle purchases.

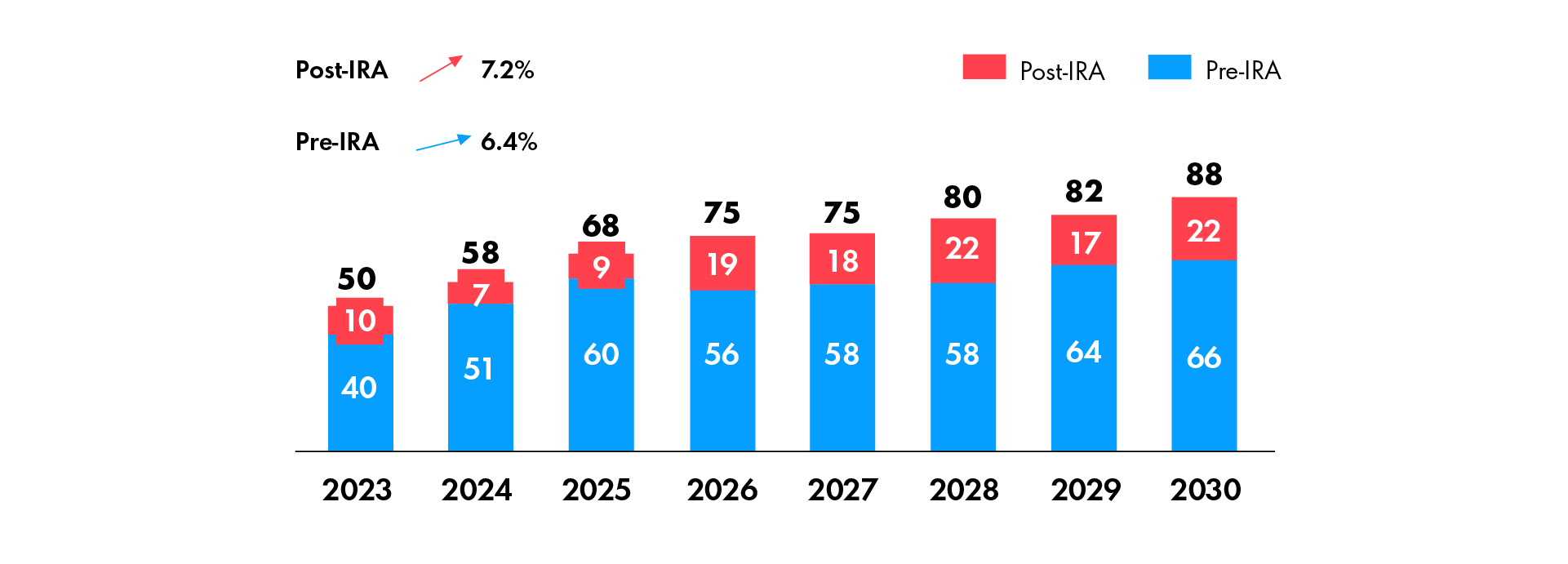

-

Source: Wood Mackenzie

Figure 1: Projected U.S. renewables capacity additions (gigawatts)

How has the push for renewables impacted renewable developers specifically? It has created both wins and challenges for the sector:

- Consolidation and competition produced some very large players (NextEra, Berkshire, Brookfield) with significant competitive advantages (e.g., cost of capital, interconnection queue positions, supply chain)

- The growth of renewables has created enormous interconnection queues and transmission constraints in nearly all U.S. power markets

- An increasing number of projects face community and environmental opposition

- Supply chain constraints and labor shortages challenge project economics, causing the levelized cost of energy (LCOE) curves—which calculates cost of energy against production—to plateau

- The growth of renewables has also increased volatility and negative prices

The IRA intensifies these challenges—and completely changes the game

The IRA, by accelerating the growth of the renewables market, exacerbates these problems but also fundamentally transforms the nature of the renewables market and what will be required to succeed. These changes fall into the following four categories: value allocation, volume, volatility and velocity.

When the intermittent resources are not available, this can lead to shortages, price spikes and oversupply when the wind blows or the sun shines.

Charting a path for success to meet the IRA’s challenges with confidence

The impacts of the IRA will build for a number of years, presenting a crucial opportunity window for developers and utilities organizations to navigate their path forward and manage risk across the business cycle (Figure 2).

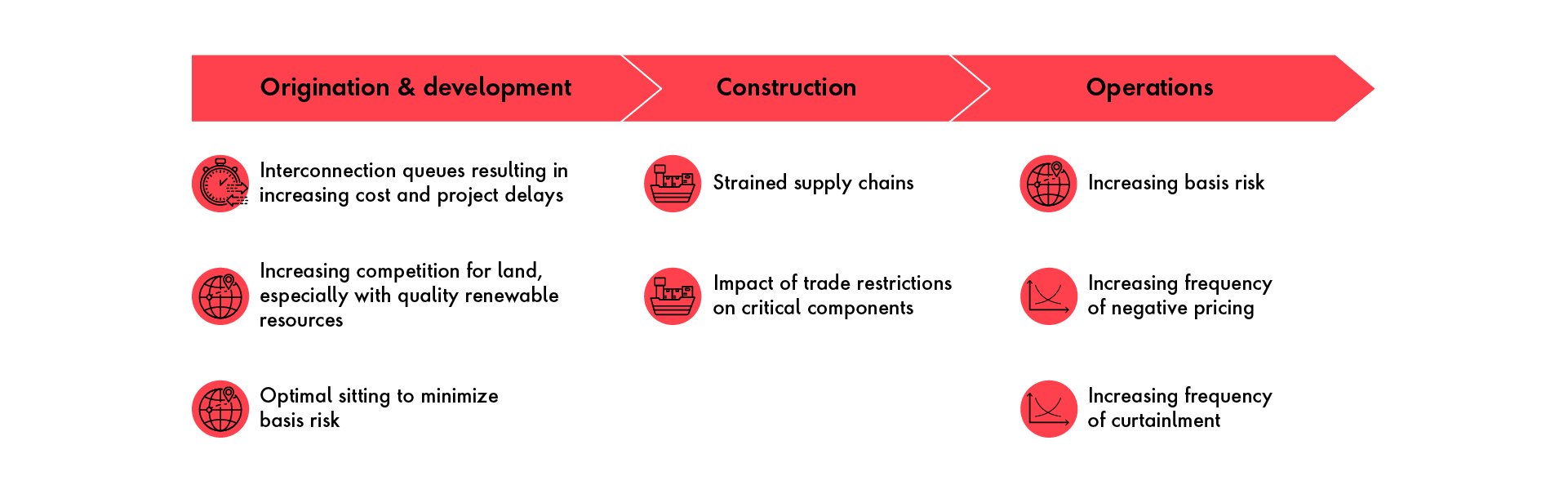

-

Figure 2: Managing risk across the business cycle

Ultimately, the ability to address these emerging challenges will be critical to an organization’s success in the renewable sector. Among the ways that developers can address these challenges:

- Gain early access to land with high-quality renewable resources

- Utilize battery storage to alleviate negative pricing and stabilize power during times of high demand or renewable intermittence

- Gain revenue certainty by supporting ESG-driven corporate renewable procurement

As the renewables sector becomes increasingly crowded in the coming years, scale will become a crucial competitive differentiator. The act of scaling equips developers with many advantages, including:

- Cost of and access to capital

- Interconnection queue position

- Purchasing power across the supply chain

- Partnerships with vendors

- Beneficial customer relationships

- Scaled operational capabilities

- Geographic diversity

Ultimately, the biggest recipient of the benefits of the IRA is the regulated utility. Utilities have the opportunity to maximize their rate base investments in renewables and storage, particularly in areas within their regulated footprint that can qualify for energy community bonus credits.

As a transformation partner, Publicis Sapient is here to meet organizations at the crossroads, plan their path forward and walk with them every step of the way.

Get in touch to discover how Publicis Sapient can help utilities navigate the IRA’s challenges.

Related Reading

-

![]()

What the IRA Means for Utilities

The Inflation Reduction Act will electrify the renewables market. How can utilities organizations seize the moment and generate new value?

-

![]()

Electric Buses Jolt V2G to Life

Vehicle-to-grid technology struggles to aggregate energy at scale. Electric buses may be the solution

-

![]()

How Utilities Can Develop a Digital Strategy

By creating a strategy for digital transformation, utilities organizations can build the tools they need to thrive in an ever-changing landscape.