What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

How Battery Energy Storage Systems are Playing a New Role in Portfolio Optimization

How Battery Energy Storage Systems are Playing a New Role in Portfolio Optimization

Boris Leshchinskiy and Will Dusek

Executive Summary

- Value-stacking strategies for batteries are moving from primarily ancillary services to price arbitrage opportunities

- Growing volatilities in energy markets across CAISO and ERCOT are driving batteries’ ROI

- An optimal strategy to maximize battery systems’ value will require agile systems to respond to volatile markets quickly, architecture to incorporate signal centricity and risk management systems, and an integrated trading and analytics platform for fast decision-making

Energy transition is inevitable as we move from an oil-and-gas-dominant world to a much more heterogenous energy mix. Incentive structures to promote infrastructure projects have accelerated renewable energy system installations significantly in the recent past. CAISO and ERCOT—two large competitive wholesale energy markets—have seen a fair share of this growth, with each deriving ~40% of their total power capacity from clean energy systems.

Batteries and BESS applications will broaden to include price arbitrage, creating additional revenue for utilities in the CAISO and ERCOT markets.

With a significant chunk of the power systems contributed from intermittent sources such as solar and wind, Independent System Operators’ (ISOs) visibility in the supply and demand (S-D) imbalance has continued to decline in those markets. This is further exacerbated by weather-related disasters such as Winter Storm Uri in February 2021, which savaged Texas’ grid system and resulted in power outages for several days. The S-D imbalance, lower visibility and grid failures have become a major concern for CAISO, ERCOT and other ISOs. Demand reduction and peak-shaving programs have shown promise, but are not capable of fully stabilizing the grid system due to demand outpacing supply.

Given the intraday volatilities driven by the new energy mix in CAISO and ERCOT, batteries and Battery Energy Storage Systems (BESS) will not only become an increasingly important part of the U.S. power grid, but their applications will also broaden to include price arbitrage, creating additional revenue for utilities in these markets.

More options for different applications

More than five years ago, batteries’ core use in the power grid was for frequency regulation. Now, their installed capacity has grown nine times in the past five years in the U.S., primarily driven by California—which makes up ~50% of the total installed capacity. However, the reserve margin in ERCOT reduced from ~14% to ~7% in 2019 and is expected to decline further. In such scenarios, BESS, which can provide economic and reliable solutions during energy crises, become a formidable piece of infrastructure in real-time and day-ahead energy markets, and will continue to do so. At the same time, battery trends are shifting from frequency regulation to other applications.

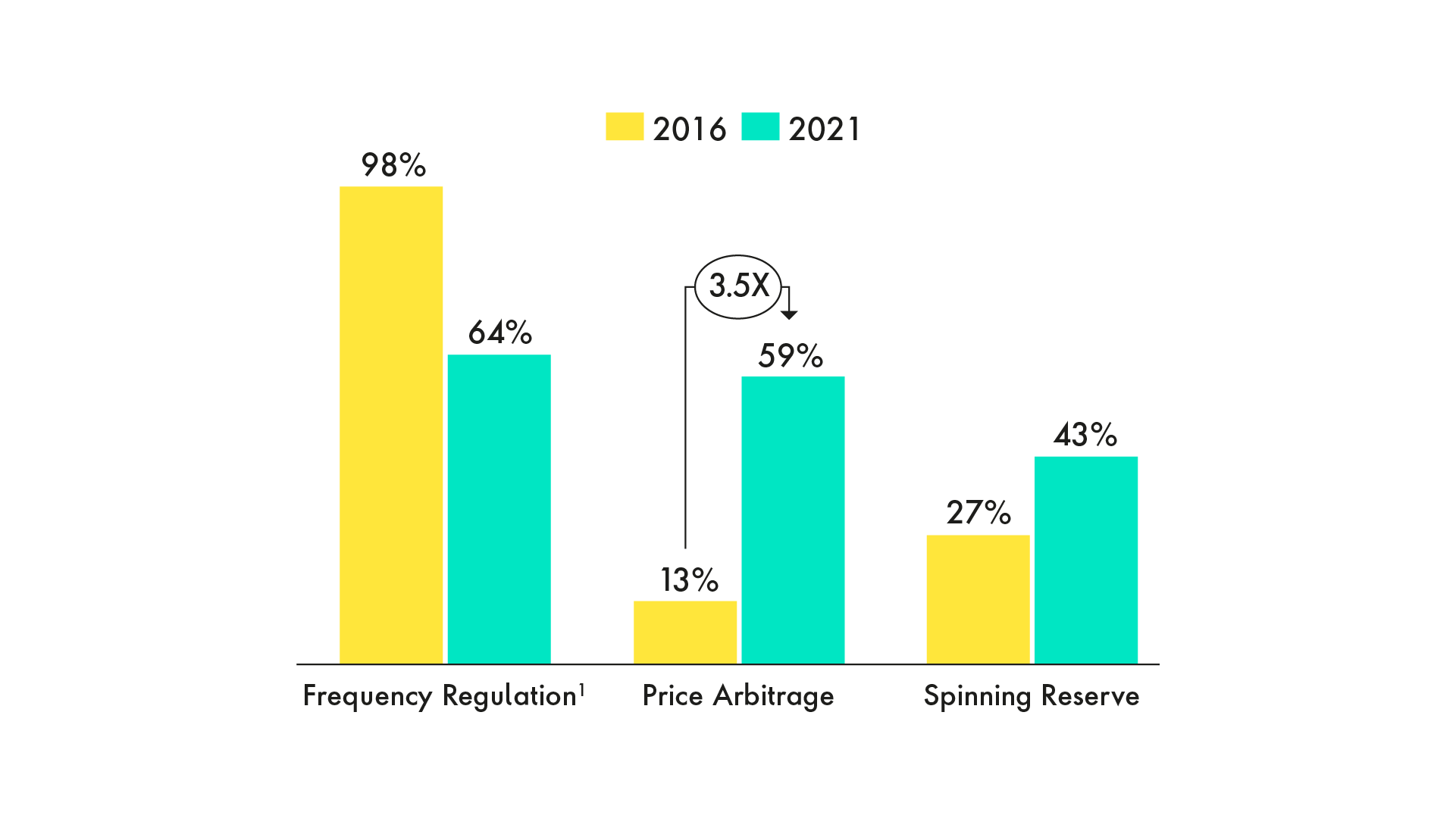

Batteries: Playing a new role in price arbitrage

Though initially viewed as a stopgap for intermittent power or an ancillary service to maintain grid integrity, batteries have a much broader potential. For example, in 2021, ~60% of batteries participated in price arbitrage, compared to ~13% in 2016. Figure 1 shows the proportion of batteries participating in various applications. Other markets that batteries participate in include capacity, spinning reserves, load management and system peak shaving. Not only do batteries improve reliability, but the widening applications also diversify revenue sources and improve returns, making batteries a lucrative asset for project developers.

-

Figure 1: Batteries’ preferred applications across the U.S., %

Note: Each battery can be tied to multiple applications at any time

Batteries improve reliability and are a lucrative asset for project developers.

Put to the test: Energy dissipated across price arbitrage markets creates increased revenue

To study the impact of price arbitration on overall revenue, Publicis Sapient analyzed three battery projects to deep dive into their transactions and revenue-sourcing strategies. The projects included project #1 (20 MW), project #2 (40 MW) and project #3 (250 MW) battery storage systems, based in San Diego and Los Angeles counties.

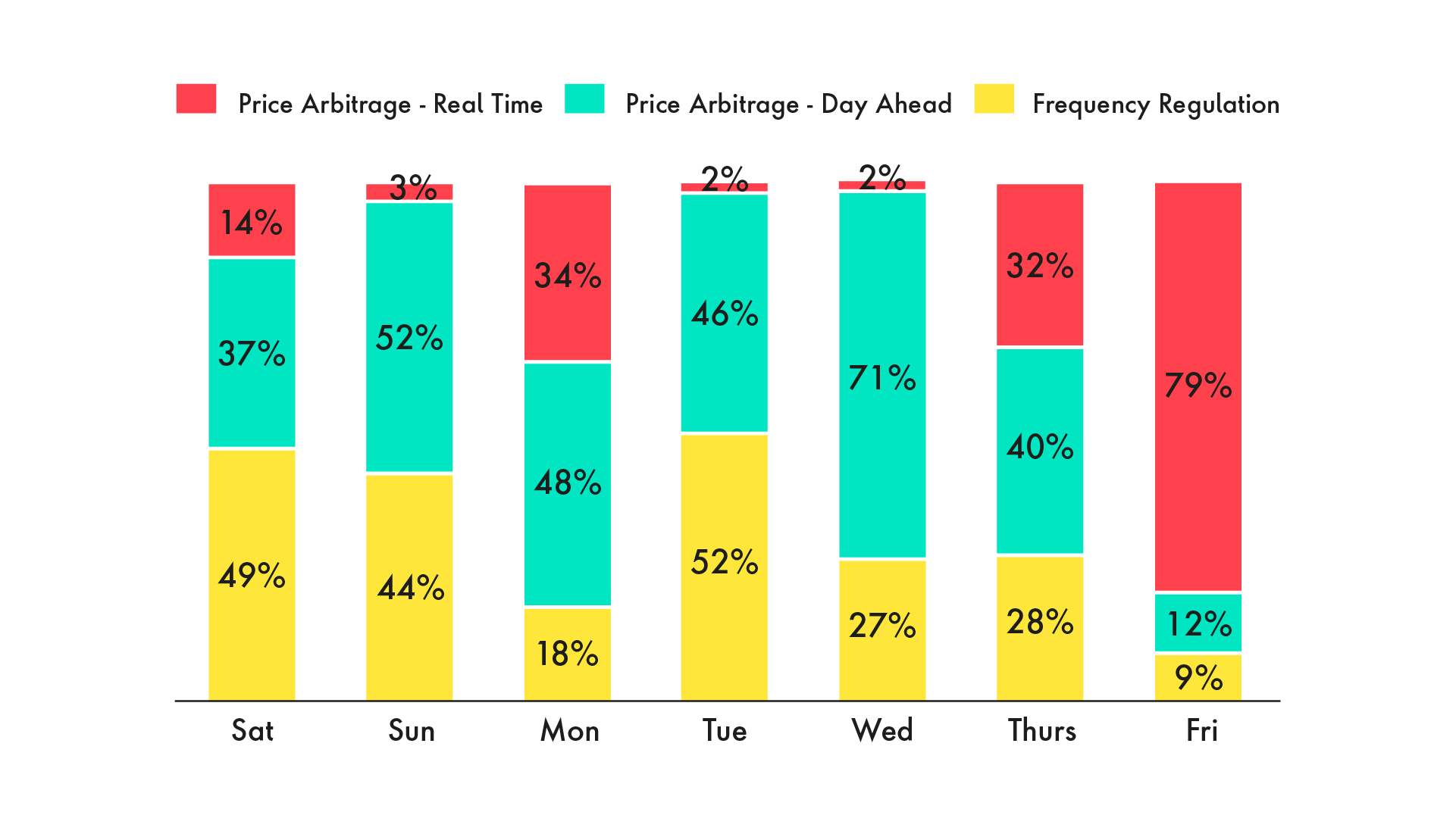

Week-long transaction data from August 22-28, 2020 for the 20 MW project showed that daily revenue varied from $9-22K, with price arbitrage driving ~70% of overall revenue while dissipating only ~24% of the total energy (MWh). As shown in Figure 2, not only is daily revenue highly variable, but the value pool varies significantly as well. Analysis also shows that about a third of revenue is recognized in ~5% of total hours, suggesting the need for an agile operating system with quick response time to capture value.

-

Figure 2: Revenue distribution for a 20 MW, 80 MWh BESS in CAISO (22-28 August, 2020)

Another analysis based on 40 MW and 250 MW battery projects showed that revenue volatility is lowest if a battery system participates only in frequency regulation markets. However, analysis also suggests that in a 20 MW/80 MWh BESS, for every 10% of energy dissipated across price arbitrage markets, an additional $0.8M revenue is realized, but revenue volatility also increases.

In order to optimize BESS operations, traders need to invest in advancing existing capabilities and acquiring new ones.

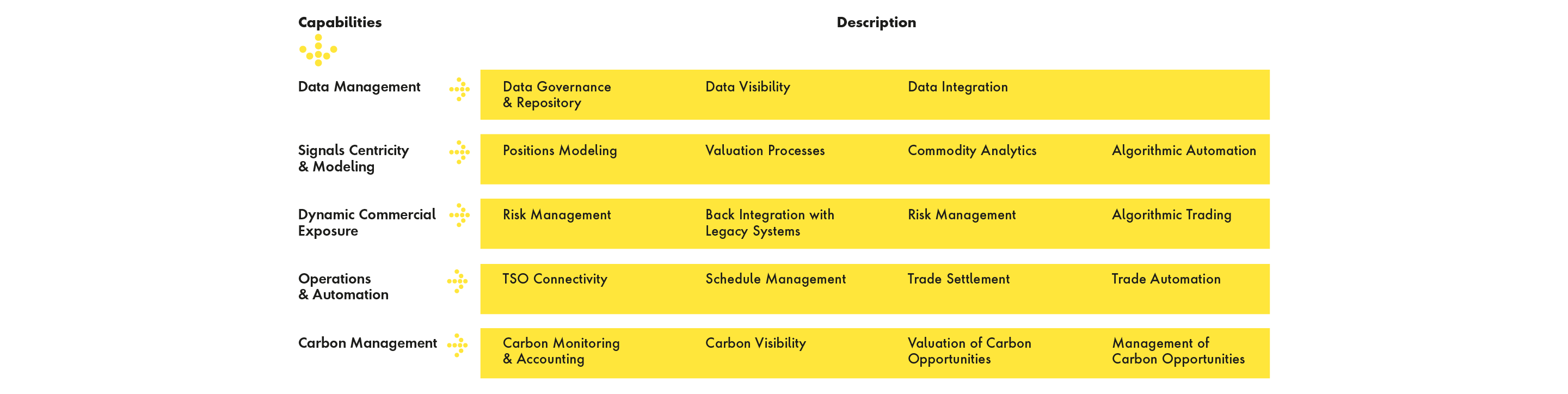

Building capabilities to optimize BESS performance

Batteries’ operations can be complex and require a new way of working to participate in volatile and evolving markets. In order to optimize BESS operations, traders need to invest in advancing existing capabilities and acquiring new ones. Our research suggests that required capabilities can be distributed across five key buckets, as shown in Figure 3. These capabilities expose commercial and operations teams to real-time markets, operations and proprietary data to make trading and operations decisions conjointly and to maximize value.

-

Figure 3: Capabilities required for optimized BESS performance

How do you activate strategies to run batteries’ fleet optimally?

Expect more market operators, renewable generators and traders to integrate DER assets into the grid and use them for commercial benefit and to ensure grid reliability. Companies will need to recognize the prevailing complexities to develop a data-driven strategy for to running the fleet. It’s best to devise a detailed strategic roadmap to understand underlying drivers and operational challenges, and to maximize the bottom line in ERCOT and CAISO markets.

At Publicis Sapient, we partner with traders to develop capabilities that create impact. Using a four-step process, we execute a rapid activation of value from various power markets available for battery storage systems.

More market operators, renewable generators and traders will integrate DER assets into the grid and use them for commercial benefit.

Our four-step approach includes:

-

![]()

Strategy & Business Models:

for example, what are the combinations of business models to approach a tipping point toward reliability and profitability?

-

![]()

Capabilities & Experiences:

for example, what blocks of the existing operating model can be leveraged and what blocks should be built?

-

![]()

Data & Technology:

such as how to leverage data signals and AI models in real time to drive better decisions

-

![]()

Operations/Execution:

how to empower business/front office with the authority and data to make the right decisions

Are you ready for what’s next in batteries? Contact us today.

Related Reading

-

![]()

The U.S. Electricity Shortage: What It Means and How to Respond

Exclusive insights and guidance about the state of the U.S. electrical grid—from now through 2035.

-

![]()

5 Data-driven Principles for Grid Modernization

How utilities industry leaders apply data to improve grid reliability, in five practical steps.

-

![]()

How Utilities Can Lead With a Digital Data Platform

A utilities’ data platform is the key to success for utilities embracing change. Read our full POV here.