What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Financial Services

Strategic Cost Reduction in Financial Services

Strategic Cost Reduction in Financial Services

Service Operations Improvement

Financial institutions are already looking for strategies to recoup some of the losses incurred during the coronavirus pandemic. Even if the virus is brought under control, the continued economic fallout will continue into the future.

Just like other businesses, banks need to think of ways to cut costs and become more efficient with what they already have.

Service operations

Among the most important steps a company can take is optimizing service operations: the activities that deal directly with the customers on a one-on-one basis. This includes call centers, bank branches and billing departments.

Some companies unsuccessfully try to cut costs by laying off workers and replacing them with process automation. Regardless of the sophistication of one’s artificial intelligence (AI) workers or software, this will not work in isolation.

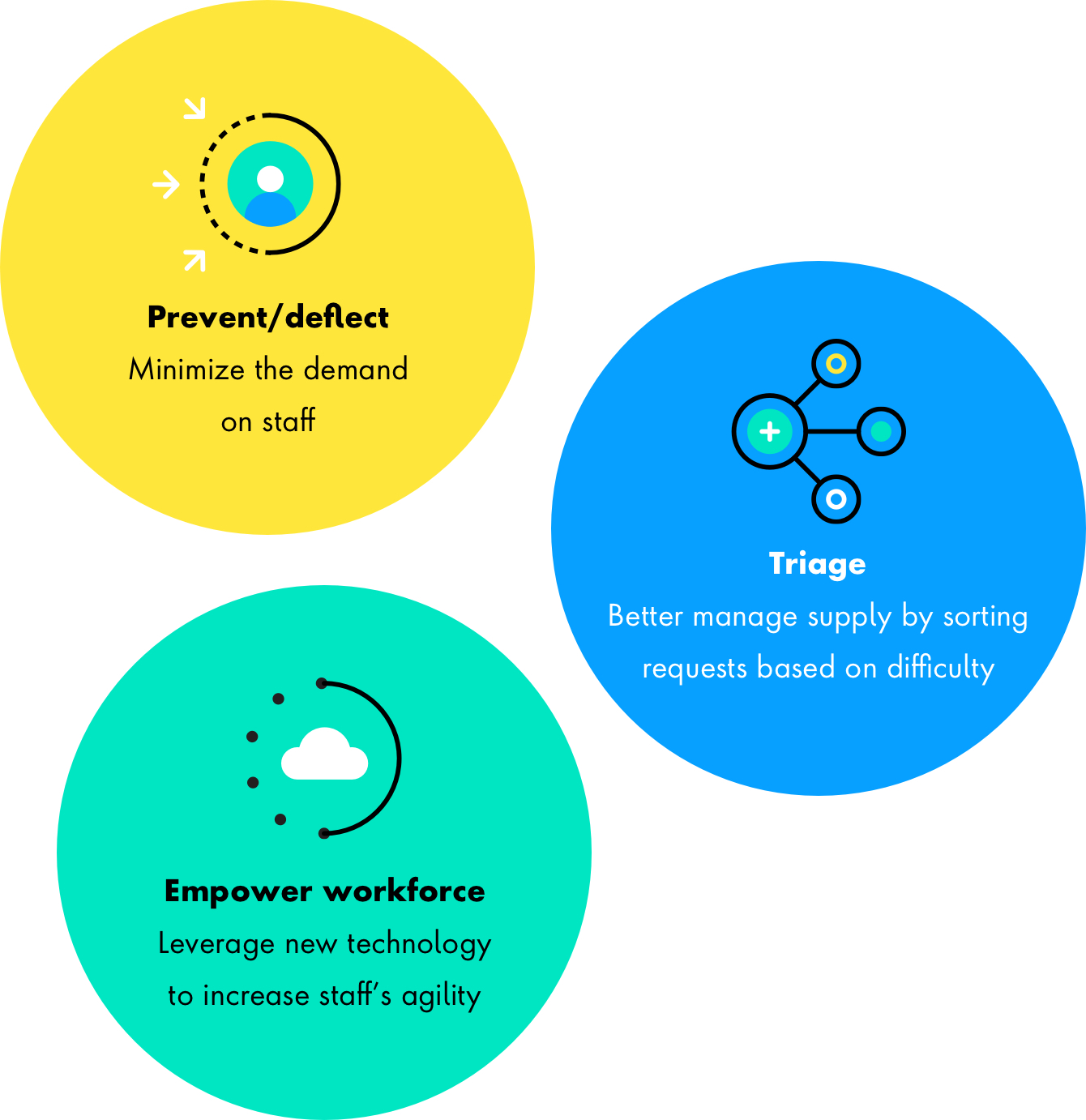

The first step to optimizing service operations is to truly understand the customer journey. Once businesses access rich customer-journey data – the kind Publicis Sapient has through Epsilon – they can streamline that service experience and make it far more pleasant for customers and prospective customers. I recommend a three-pronged approach:

Businesses can accomplish all three by preventing calls by addressing the customer’s issues proactively, intercepting calls with AI so they don’t burden the staff, ensuring the necessary calls go to the right recipients and enabling employees to thrive so they are satisfied, fulfilled and productive.

Contact centers are a clear example of where service operations can be improved. They often have hold times of as long as 90 minutes, so it is difficult to connect during a crisis. In the short term, companies must figure out how to support such a large staff. Nevertheless, in the long term, they need to figure out how to deliver better-quality customer and employee experiences while making their shops more efficient?

The attrition rate for call centers is around 20 to 30 percent because no one likes being on the phone all day.

To optimize the customer experience, companies should use analytics, AI and data capabilities to address the customer’s issue before they contact them. It’s important to understand that people of a certain age and zip code typically call about a specific set of problems and build a set of hypotheses and treatments. For instance, if bills are a common problem, one can build a digital capability into the statements so the recipient can easily access an explanation or FAQ page.

Data can help predict who will need service and provide it before they even think to call.

If the customer needs to reach out, would the business be able to redirect that request to a digital channel, such as self-service, chatbots or virtual assistants?

It’s worthwhile to deflect self-service calls but in other cases they should go directly to a representative. This would be especially true for sales situations where we’ve found digital only converts 10 percent whereas a salesperson converts 30 percent.

So, companies should not aim to deflect all calls. They need to identify which calls to deflect and which calls to bring into the organization.

When a call does come to the contact center, the business has to address it. Now it needs to make sure the call goes to someone who can resolve it. Nevertheless, sometimes the wrong number receives the call.

In these cases, the caller will usually get an interactive voice response (IVR), an automated system that interacts with callers and routes their requests. It’s important to have a conversational and accurate IVR that can connect the caller with someone who can actually help them end-to-end. These calls also need to be triaged: assigned degrees of urgency and difficulty.

If the IVR merely has the caller choose from a redirection menu it’s likely the call will be misdirected to someone with no expertise in this issue and redirected again. Chatbots have evolved so new versions can handle requests much better.

Businesses can separate out this work into simple, medium and complex. There might be 10 divisions, but they can start putting brand-new agents on the simple stuff. For instance, in the world of car insurance, there’s no reason for someone who’s been with the company for 30 years to spend their time dealing with a chipped windshield claim.

Simple calls

Most calls deal with straightforward-enough issues that they should only last about two minutes but they can last as long as 15 minutes. The customer service reps need to have the right technology to facilitate this.

Workers at large financial services companies can have up to 22 screens open at any given time. As such, monitors can be one of the biggest expenses. This extends and complicates the process. Instead, the reps need a screen that lets them solve the call easily with three features:

- Information on the most well-understood problems they're qualified to solve

- A view into what the customer has been doing up until now so they're not repeating the same questions

- The ability to co-browse on the same screen as the customer

This empowers the newer agents to tackle high volumes of the simple requests. Eventually, the business might be able to digitize these problems but there’s clearly no reason for more experienced staff to get involved.

Complex calls

Other times, issues are far too complicated to solve as quickly. They require experts who have the time to weigh in on unusual situations. What volume of work can these agents handle without diminishing returns? What’s the best way to identify what’s worth their time?

Natural-language processing enables detailed analysis of call recordings for a better understanding of what it was all about. Then AI could identify who was finally able to resolve that call. Pinpointing that helps determine where future calls should be routed so the next customer isn’t transferred four times.

Another reason the experienced agents will be more efficient is that they won’t need to fix issues that less-experienced agents handled.

Normally in call centers, call center agents handle everything on a first-come, first-serve basis. That means the business can take out 40 percent of the cost by saving experienced agents for complicated issues. If only the lowest cost agents handle the simple issues, they're going to do it much faster.

Cross-selling

After addressing the initial inquiry, through “next-best-action marketing,” call center representatives should look at the remaining time on the phone as an opportunity to cross-sell: sell another product or service to the existing customer.

It would be wise to have several additional products connected to common problems so the representatives are prepared with a customer-centric offer. By selling the additional product, staffers can make the company a bit more money while helping the customer handle their issue more effectively.

Another layer is workforce management. Most calls to contact centers take place between 6 a.m. and 9 a.m. and between 5 p.m. and 8 p.m. This is a dilemma because most call-center staff also want nine-to-five jobs.

By understanding the seasonal nature of demand, the business can forecast what it will need and make medium and long-term plans.

It is vitally important for call centers to adopt cloud-based systems, which enable staffers to work from home. Since necessary tools are stored on a network of servers rather than locally, the staff can service customers with their laptops and headsets from home – in a secure environment. Companies can structure the work schedule so some employees only work from home only at peak hours or emergencies. This could help the business meet urgent demand or persevere throughout a crisis – without missing a beat.

New technologies give staffers more options when handling calls. Sophisticated dashboards on a single pane of glass let employees easily peruse information when speaking with customers, so they can respond to difficult questions with speed and insight. It also allows for co-browsing with callers.

It’s important for companies to invest in their staff’s development and job satisfaction. It’s better for everyone if they want to stick around longer and become even more effective.

A word of caution

Most executives tasked with reducing costs take an inside-out look at the company. They might ask staff involved in service operations what kind of work they do to identify redundancies or jobs that could be automated. If it can be offshored, that’s what happens. If it’s not value-added work, it gets the axe. But this is wrongheaded.

Once the COVID-19 crisis is over, businesses don’t want to turn around and realize they just fired half of their workers with no strategy for the future. They want to position themselves so they can grow again without hiring that full contingency back. They want a more customized customer journey and to be more efficient so the next time they want to grow by 20 percent, they only need to grow their staffs by five percent, whereas before it was linear.

Improving service operations will strategically cut costs and strategically cutting costs will improve service operations. It’s a virtuous cycle. Business leaders can accomplish both.

A company can improve service operations by decreasing the workload through automation, sorting assignments based on difficulty so veteran staffers can handle more complex work and empowering the staff with new technology to produce greater value. Companies that follow this path will become more successful in the COVID-19 era and position themselves for further success for years to come.

Read the rest of the series: