What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Insight

Monetizing First-Party Data: Data Cooperative, Media Network or Both?

Monetizing First-Party Data: Data Cooperative, Media Network or Both?

Complementary strategies that support different KPIs.

With the demise of third-party cookies, companies are pursuing new ways to understand their customers and personalize advertising. Organizations’ first-party customer data, collected with the customer’s consent via a loyalty app, website or in-store Wi-Fi, is extremely valuable for other companies whose customers overlap and are looking to increase reach, brand awareness and sales.

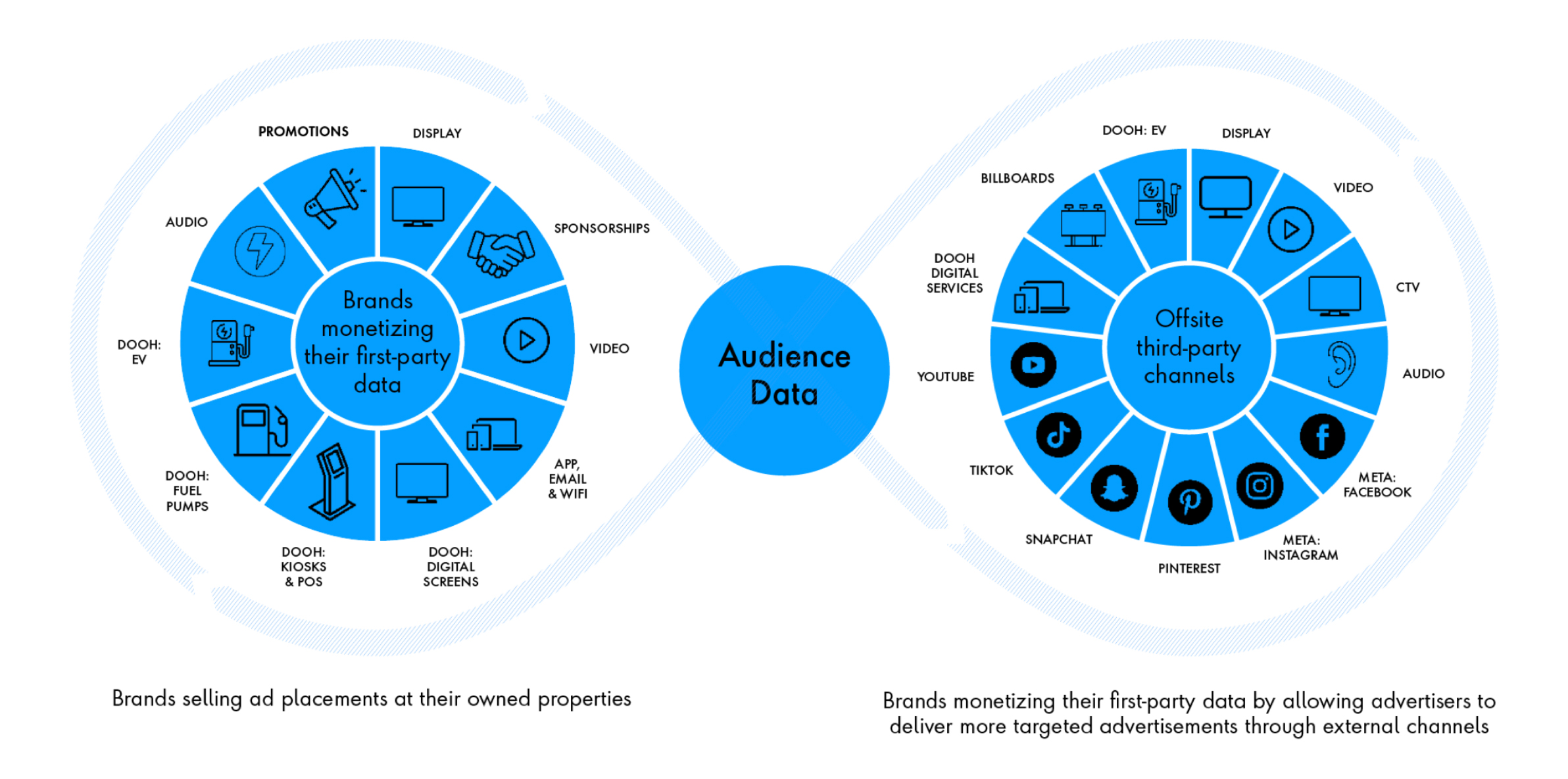

Organizations can monetize their first-party customer data with a data cooperative (data co-op), media network (MN) or both. It’s not an either/or decision: Data co-ops and MNs are geared toward different goals and key performance indicators (KPIs).

Data co-op: Sharing privacy-protected first-party data from customers

Data co-ops are the digital equivalent of marketing co-ops. While marketing co-ops share advertising costs, such as a perfume TV spot ending with “Available at Retailer A,” data co-ops share first-party customer data that’s been stripped of personally identifiable information (PII) in a data clean room. The company that operates the co-op typically charges a subscription fee to other members, helping to convert customer data storage from a cost center to a high-margin revenue center.

Membership in a data co-op will appeal most to brands and suppliers that sell through shared stores or digital properties, so-called endemic companies. These companies are focused on KPIs like awareness, reach and new customer acquisition. Sometimes they are also looking for a sales lift, for example, by identifying lapsed buyers of a particular product to target in an email campaign.

Data co-ops are the digital equivalent of marketing co-ops. While marketing co-ops share advertising costs, such as a perfume TV spot ending with “Available at Retailer A,” data co-ops share first-party consumer data that’s been stripped of personally identifiable information in a data clean room.

Publicis Sapient sees two major changes in data co-ops on the horizon. The first is an uptick in partnerships between non-endemic companies that have overlapping customers. For example, a hotel chain and an airline each have customer data that’s valuable to the other for targeted marketing purposes.

Second, following the example of customer relationship management (CRM) platforms, data co-ops are evolving to include digital signals about customers’ media exposure and whether the exposure resulted in the desired conversion action, such as a purchase.

Media network: Selling targeted advertising on owned and paid channels to give customers relevant ads

MNs can bring in exponentially more revenue than data co-ops, though they are also more challenging to build. A MN is a company-owned advertising platform that uses the company’s privacy-protected first-party data (and sometimes second- and third-party data) to target advertisers’ likely customers and give them near real-time insights about campaign effectiveness. Although commonly referred to as retail media networks (RMNs), they aren't only for retailers any business with a cache of customer data can use it to open up a new revenue stream with MNs.

Think of the MN as the digital equivalent of physical marketing displays, like endcaps, tent pole events and shelf tags. Ads appear on owned channels—such as the MN operator’s websites, apps, in-store kiosks and check-out terminals—as well as paid channels, like Meta. A major retailer Publicis Sapient worked with earns nearly half of its RMN revenues from paid channels. By one estimate, the retail media market will grow by 25 percent per year from 2022 to 2027 and reach $100 billion in 2027.

Where companies join data co-ops to expand reach and awareness, they advertise on MNs to drive incrementality—that is, actions that can be directly tied to the ad through empirical measurements. MN advertising is most valuable for suppliers looking to boost sales through a specific partner: the company that operates the MN.

A media network is a company-owned advertising platform that uses the company’s privacy-protected first-party data (and sometimes second- and third-party data) to target advertisers’ likely customers and give them near real-time insights about campaign effectiveness.

Picture a cosmetic brand aiming for incrementality at a cosmetics retailer, an insurer wanting to sell more policies through a particular automaker’s dealerships or an energy drink brand that wants to reactivate lapsed buyers at a specific convenience store chain. Only a MN operator, with its first-party data, can provide advertisers with closed-loop measurements such as “Customer 123 was exposed to Media B on April 30, and performed the desired conversion action on May 2.” Suppliers looking for a general sales lift, in contrast, can often meet their goals at a lower cost by advertising on a demand-side platform (DSP) like Google Display & Video 360 (DV360) or Trade Desk.

What outcomes can companies expect from building and operating an MN? The main one is a new high-margin revenue stream. Organizations could maintain margins of 30 to 50 percent compared to typical 2 to 4 percent margins for the main retail business. Additional revenues flow in from successful supplier campaigns, which increase foot traffic and sales from the supplier’s product (like corn chips) as well as complementary products (such as guacamole and salsa). Finally, data from advertisers’ campaigns can be useful for fine-tuning an individual company’s media strategy. If a supplier sees good results from an ad placed on an extreme sports channel, so might the company.

Data co-ops and MNs are complementary. By building both, businesses position themselves to earn revenue from companies looking to expand their reach and awareness through data co-ops, as well as drive incrementality through MNs. While significantly more complicated and costly to build, MNs have the potential to bring in exponentially more revenue—20 times more for one major retailer. Where a company decides to start depends on its appetite for technology integration and change management, senior leadership’s commitment and cost considerations.

Where to start: Identifying six make-or-break success factors for data cooperatives or media networks

How organizations design and manage their offering will have an enduring impact on their competitive advantage, costs and lifetime revenues. The following are best practices for building a successful data co-op or MN, no matter the industry.

1. Make change management a priority

At the outset, it’s important to ensure that executives and all affected departments understand the value of the data co-op or MN to the organization and to individual departments, as well as how processes will change. Get buy-in from the heads of digital marketing, data and analytics, MarTech, owned experiences, digital advertising and digital transformation. Organizational alignment is crucial. For example, merchandising teams that have offered free digital advertising as a deal sweetener to suppliers who purchase physical marketing displays need to understand the value of the MN to the company, which ultimately benefits their team.

2. Set realistic expectations

Whether starting with a data co-op or MN, set expectations with all stakeholders that revenues may take several years to reach their full potential. For example, a RMN Publicis Sapient built for a major U.S. retailer brought in $24 million in revenue in its first year, which grew to $150 million by the fourth year—a 625 percent increase. In general, MNs require a significantly larger investment than data co-ops and bring in more revenue potential. Another Publicis Sapient client saw $5 million in year-one revenues from its data co-op and $100 million from its MN.

3. Establish a data quality management function

Data is like crude oil in that it needs to be discovered, extracted and refined before it’s taken to market. Whether starting with a data co-op or MN, organizations should invest in data modernization to improve data quality, adopting best practices for extract, transform and load (ETL) processes. This involves bringing in data from various sources, including the loyalty app, website, in-store transactions and actions taken in response to ad impressions. Identity resolution software, such as Epsilon COREID or LiveRamp, enables this while also stripping PII from customer data to comply with privacy requirements.

In addition, the following success factors are important to consider specifically for MNs:

4. Report on incrementality

With advertising options ranging from Google Ads to social media, why would brands and suppliers spend their ad budget on a particular MN? In a word, incrementality—metrics showing whether an ad impression seen by a customer directly resulted in the desired conversion action and how much of the sale is a result of the ad. Advertisers can benefit from a centralized planning portal for audience targeting and reporting, such as Publicis Sapient’s RMN Accelerator. Advertisers can use the portal to identify their target audience, such as lapsed buyers or households with two children under 18 and a certain income. They can also conveniently generate performance reports that compare conversions for different audiences, messages, calls to action and more.

5. Aim for shorter attribution lookback windows

Many of today’s MNs give advertisers a 30-day lookback window. But attributing a customer’s latte purchase to an ad seen 30 days earlier is a stretch. Similarly, data syndicates typically report on sales lift four to eight weeks after the campaign’s end, too late for advertisers to apply insights. To set MNs apart, businesses should design them to support a shorter—and therefore more relevant—attribution lookback window.

6. Share near real-time incrementality measurements so advertisers can optimize campaigns while they’re in-flight

Imagine a campaign aimed at successfully reactivating lapsed buyers of a chocolate bar brand. With real-time incrementality measurements, the marketer can run experiments to see if reactivated customers will continue purchasing the item without the need for additional discount offers.

How Publicis Sapient can help

A successful data co-op or MN requires the right technology and the right processes. While some companies may already have digital media teams with the necessary skills and scale, others may need to work with an experienced IT services provider that offers a build-operate-transfer service. With this arrangement, the partner sets up, optimizes and runs the media network for a set period of time while the company’s team learns, and then transfers over operations.

Reach out today to discover the transformative power of data co-ops or MNs and how Publicis Sapient supports businesses on every step of their journey.

Related reading

-

![]()

-

![]()

How Monetizing First-Party Data Produced a $100MM Opportunity

We partnered with this grocer to create a bespoke Retail Media Network.

-

![]()

Customer Engagement Solutions

From data to disruption: Unleash your customer data & turn your insights into assets while transforming into a customer-centric organization.