What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Retail Bank

How a Leading Retail Bank Put Customers First by Anticipating Their Individual Financial Needs

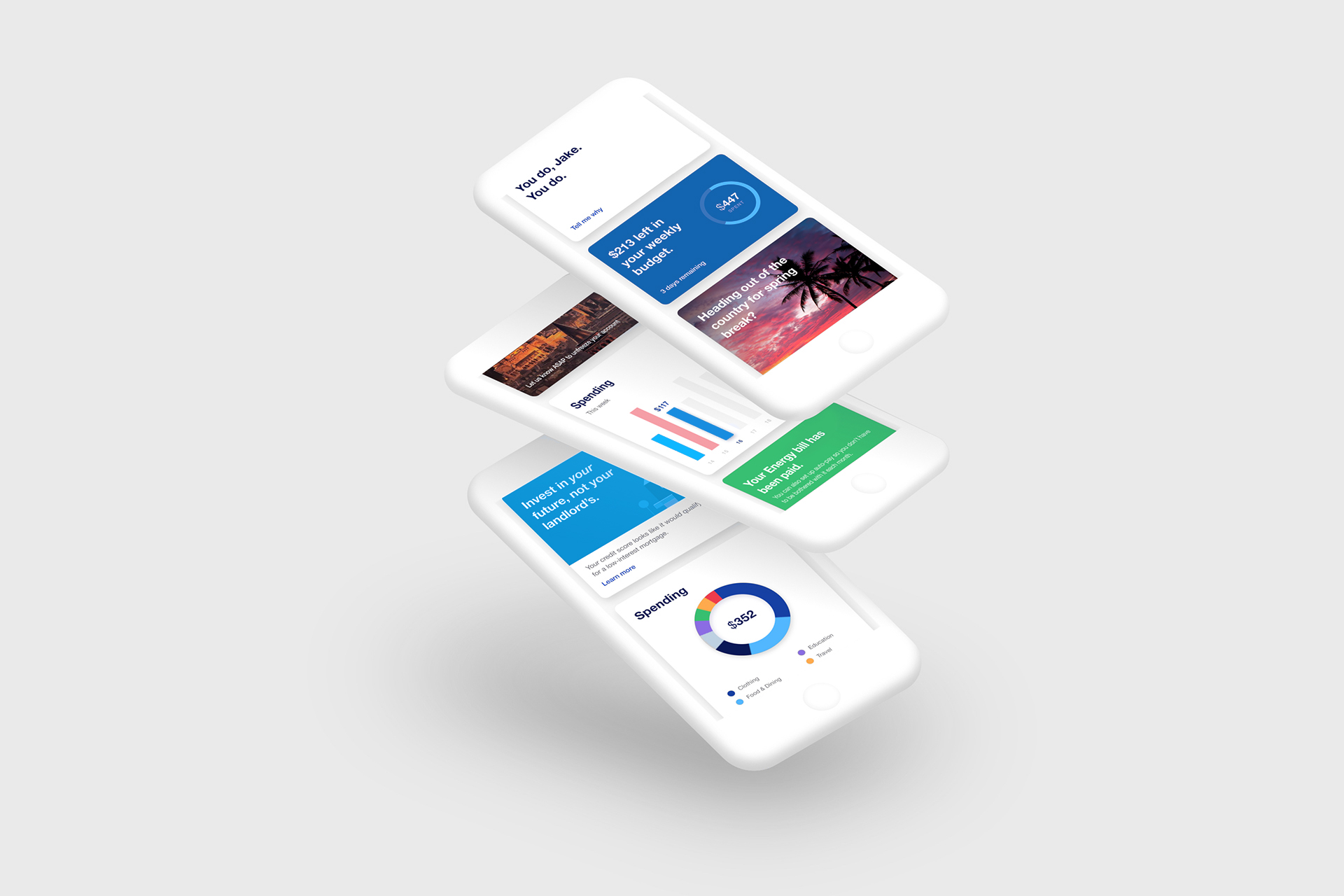

We created a breakthrough mobile app with unprecedented customer-centricity.

In a world of rapidly changing bank customer experiences and expectations, this US-based bank needed to put ultimate convenience and power in the hands of every customer. That’s why we reimagined a breakthrough mobile app experience that anticipates customer needs and seamlessly guides them through their daily lives.

The Imperative for Change

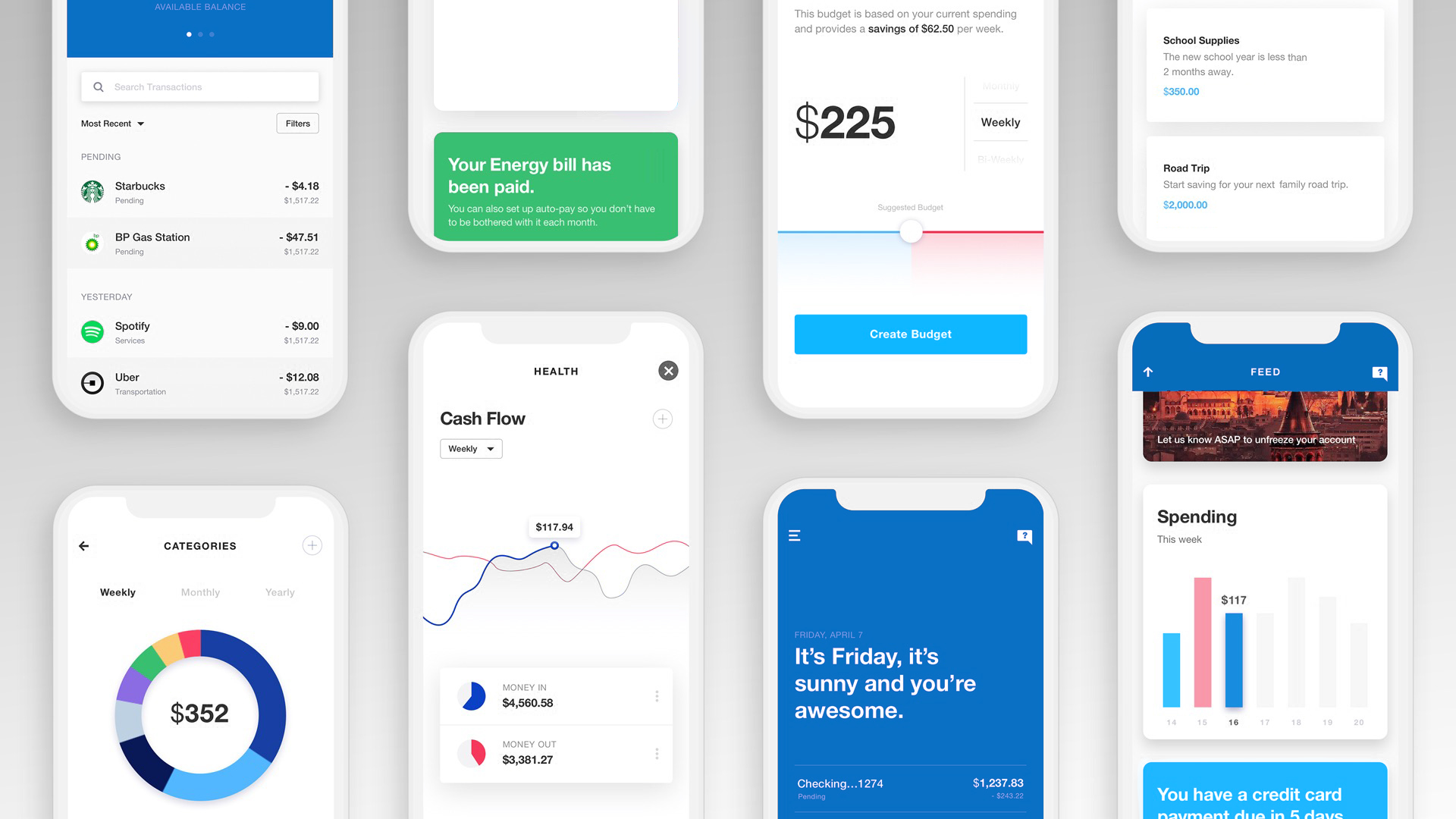

Banking apps are good at handling basic functions like viewing transactions and paying bills. But our client realized that people expect far more insight and guidance from their bank, especially when compared to other leading-edge digital experiences. That fact, combined with the potential for a vast amount of customer insight, compelled the bank to enlist Publicis Sapient to reimagine and re-engineer the entire app experience with customer-centricity in mind.

The Transformative Solution

Working alongside the bank’s employees and actual customers throughout the entire process, we formed several co-located strategy, research, design, development, and agile delivery teams across four time zones. Our combined expertise delivered a brand-new, customer-obsessed app that removes typical money management obstacles and powers individual insights through intelligent data.

“The Publicis Sapient team helped set a vision for the app and then brought a startup mindset and agility to the team that allowed us to create the app in under a year—less than half the time needed to make a traditional full banking app.”

Client Executive

The Business Impact

This one-of-a-kind banking app increased customer trust and loyalty from day one by anticipating customer needs, guiding their financial decisions, and ultimately helping people feel secure and in control of their money through practical, intuitive features like:

From an organizational perspective, we’ve helped set a new vision for our client as a customer-obsessed, digitally driven organization.

Partnering closely with the bank, we’ve brought that vision to life. The bank’s mobile app was delivered to all customers in half the expected time, and the entire program embraced best-in-class agile principles and methods from beginning to end.