What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

3 Strategies to Utilize Retail Media Networks for Profitability

The retail industry is transforming from an industry powered by transactions to an industry that runs on data-powered retail media. In fact, some retailers say that their marketplace fees and ad sales will become more profitable than sales of merchandise within the next five years alone.

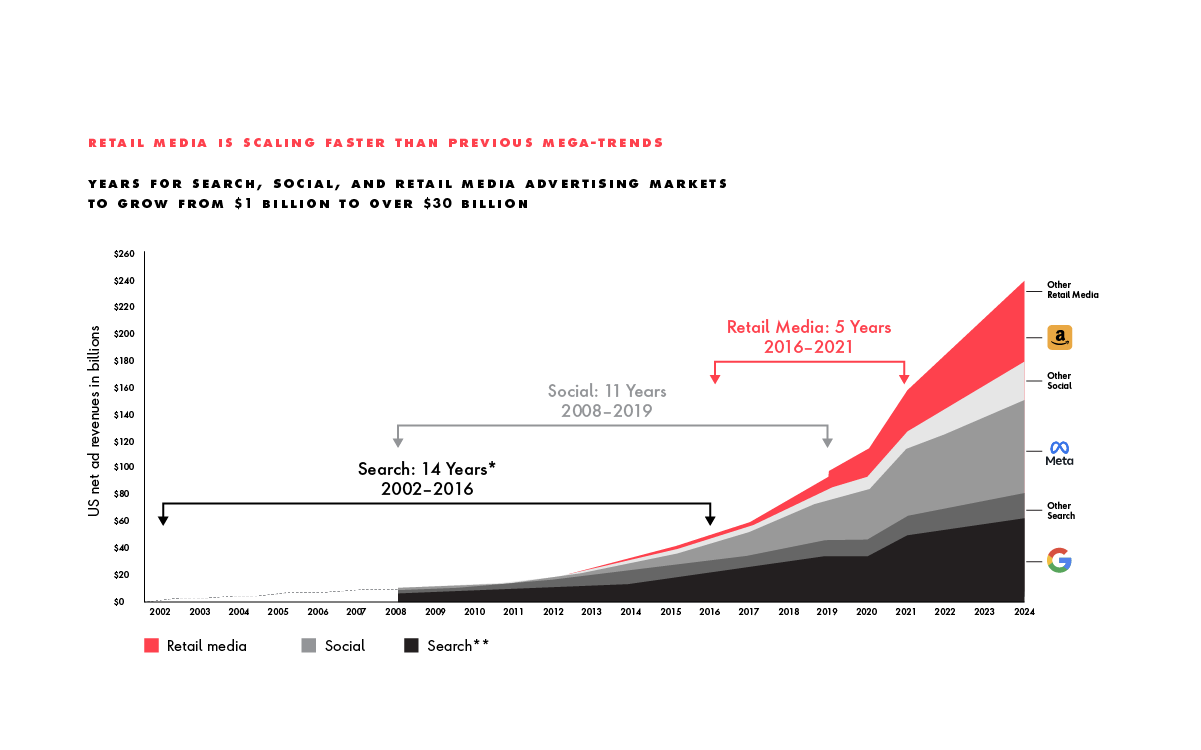

This is all part of a continued trajectory of the fastest-growing digital ad format in history. Retail media has reached $30 billion in revenue faster than both search and social, according to Luma Partners, and continues to fill a market need for consumer packed goods and branded manufacturers. Reuters projects that by 2028 revenue from retail media networks will account for 15.4 percent of all revenue from ads, eclipsing television as an advertising platform. Companies that use RMNs are seeing maximum ROI from untapped customer data and reaching highly engaged audiences.

With retail media’s distinct advantage of owning customer transactions, advertisers can trust the closed-loop measurement available in retail media is proven performance for their ad dollars.

In 2023, retailers have been feeling increasing pressure to prioritize cutting operating costs over topline revenue growth. Looking forward, 2024 provides an opportunity for a long-term retail media profitability play that also drives customer lifetime value (CLV).

Unlock Retail Media Network Profitability with AI

Tune into our conversation with Macy’s to discover Gen AI opportunities across the retail media network value chain, and strategies for maximizing your revenue potential.

Here are some key strategies that retailers can consider to increase RMN profitability in 2024:

- Expanding into new markets

- Creating a value proposition for consumer-packaged goods (CPGs)

- Hyper-personalizing ad experiences

Expanding into new markets

The proliferation of RMNs has not yet fully translated to the European market, leaving an opportunity for global retailers across sectors to establish themselves as regional leaders.

Because many European retailers hesitate to invest more heavily in RMNs due to a lack of confidence in returns from the European market, there is a massive opening for technology expansion in this market that begins with better targeting and data strategy.

“It’s becoming more and more necessary for European retailers to harness their first-party data for more advanced targeting strategies,” says Elliott. “Implementing more precise audience segmenting is what will elevate not only your RMN, but any digital advertising.”

In June 2023, Albertsons Media Collective proposed new industry-wide standards for RMNs, which include transparency on RMN capabilities, like targeting offerings. As the industry begins to more openly disclose how RMN metrics are calculated, retailers with robust first-party data capabilities in Europe and beyond will rise to the top.

The RMN value proposition for CPGs

Another strategy to increase RMN profitability is to collaborate with competitor CPG brands outside of the retail industry. These collaborations would allow retailers to stitch together smaller pieces of data from many different contexts in real time.

For example, customer purchase history at a grocery retailer can inform RMN targeting for a CPG brand looking to increase repeat purchases. But combining purchase history with a customer's streaming data can identify new customer segments with targeted advertising, like easy weeknight meals for parents turning on kids shows, or health and wellness supplements for customers streaming workout classes at home.

These legal and privacy data cleanroom collaborations will fuel advanced targeting within the next generation of RMNs, creating a much more engaging customer e-commerce experience.

“There's a hesitancy out there that advertising could interrupt the e-commerce experience. But seamless advertising deepens customer engagement and improves customer experience with personalization across advertisers and house brands.”

Ray Velez, Executive Vice President at Publicis Sapient

Hyper-personalizing ad experiences

While robust loyalty programs are already the backbone of successful RMNs, retailers have an opportunity to kill two birds with one stone by further segmenting loyalty members to use as a testing ground for new offers and targeted advertising.

In most cases, loyalty program segments are differentiated by recent spend and/or points accumulation. An incredibly diverse group of customers are all hit with the same blanket offerings and promotions, a spray and pray approach. While the contact information that these loyalty members provide is valuable on its own, RMNs that further segment their promotional offers within their loyalty programs receive higher engagement and return business.

For example, a delivery driver that frequents a U.S.-based convenience store for snacks will appreciate very different offers than a single mom stopping by for coffee on her way to work. A monthly coffee subscription that allows the latter customer to accumulate points to save on gas would not be appealing to the former customer. A BOGO snack and hotdog promotion notifying the former customer as they pull in for a rest stop wouldn't be appealing to the latter customer.

Generative AI can also enable these unique dynamic ad experiences for customers. While RMNs can segment audiences, Gen AI can analyze vast amounts of consumer data to identify specific audience demographics and behaviors. Using this data can help generate tailored ad copy and visuals based on real-time time customer data, improving ad performances and click-through rates. Gen AI is the key differentiator, helping retailers stay ahead of the competition.

Unlock Retail Media Network Profitability with AI

Tune into our conversation with Macy’s to discover Gen AI opportunities across the retail media network value chain, and strategies for maximizing your revenue potential.

Expanding e-commerce marketplaces

At the same time, less active loyalty members are also a diverse group that retailers can target more easily using services marketplaces. While a business customer purchasing farm equipment may only need to replace their products once every five years, retailers can offer maintenance services and other farm goods through third parties, turning an inactive loyalty member into a data-rich customer profile that can be nurtured and leveraged.

By taking advantage of these opportunities, retailers can position themselves for long-term growth and success in the rapidly evolving retail media landscape.

2024 retail media trends and recommendations by sector

However, retailers should also think about consumer behavior trends within their sector when it comes to 2024 investments.

These are the top retail media network recommendations from our industry experts, based on consumer trends, proprietary research and sector expertise:

Department store retailers

Fast-fashion returns proliferate: Gen Z will continue to opt for low-cost and fast-fashion; to keep costs down, retailers will need to find ways to connect supply chain data with retail media advertising to optimize supply and demand.

B2B retailers

B2B sales go digital: While B2B sales thrive on customer relationships, younger B2B customers are craving streamlined, digital sales processes that they're used to in their personal life through marketplaces and hybrid sales processes.

Grocery retailers

RMNs combat brand switching: As many customers switched to owned brands to combat inflation, CPG brands will continue to rely heavily on RMNs to lure customers back to their products, despite the fact that CPGs will compete with ads from these owned brands.

Convenience store retailers

Loyalty-based promotions bolster RMNs: C-store retailers can build strong RMN networks through closed-loop measurement via in-store screens and in-app advertising, relying on frequent visits and promotions served up through loyalty programs.

To craft your retail profitability strategy, contact Guy Elliott and Ray Velez below.

Related Reading

-

![]()

Retail Media Networks

Build a new revenue stream and a better brand experience. Get started in as little as four weeks.

-

![]()

Bespoke Retail Media Network

We partnered with this grocery chain to monetize data to the tune of $100MM.