What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Across the fast-evolving landscape of modern banking, institutions like Lloyds Banking Group (LBG) are steering their course towards digital transformation.

Publicis Sapient is the robust product engineering partner guiding them through this, navigating pivotal initiatives such as core banking modernization, cloud foundation, internet banking modernization, data platform creation, credit risk transformation, and the modernization of retail, and commercial banking.

This digital metamorphosis is further catalyzed by the incorporation of cutting-edge technologies, with Generative Al playing a key role.

Getting transformation ready

To create impact and drive successful business transformation, Publicis Sapient focuses on its five SPEED capabilities strategy, product, experience, engineering and data integrating them into their clients' products, services and experiences.

Pinak Kiran Vedalankar, GVP Technology at Publicis Sapient, explains that through this approach, the partnership enables the business to reorient towards the customer, establish the right mindset to engineer the delivery of technology, and scale the key enablers of banking as a service: "We bring the five SPEED dimensions together to form our macro approach."

-

![]()

Strategy

Testing the hypothesis on priority value pools to power the business growth

![]()

Product

Bringing the engineering mindset and an agile delivery approach to capability and enablement

![]()

Experience

Creating value for the end user and colleagues while designing delightful and useable digital experiences

![]()

Engineering

Building modern, scalable and high- performance platforms and solutions to enable the UX and the operational vision from the product and experience side

![]()

Data and AI

Leveraging data and Al to measure performance, derive insight and support data- driven experiences

Lloyds Banking Group: A Technology and Business Strategy

Martyn Atkinson, CIO for Consumer Relationships and Mass Affluent, explains how Lloyds Banking Group is undertaking the largest transformation in financial services.

Establishing the right mindset

"How can we act like an enterprise startup?" asks Pinak. "The focus is on becoming customer-led rather than business- and IT-led.

"The approach requires fast delegated decision making rather than top-down governance. At the macro level, how do we release new products when there's a value to customer rather than releasing only when something is perfect? How do we enable VC-style funding rather than doing project specific business cases? And how do we get a single multifunctional end-to-end team rather than just IT and business teams being co- located to each other?

"When it comes to the actual execution, we're looking beyond the fixed triangle of time, cost and scope—we believe in a fundamental mindset shift focusing on speed, quality and value."

Generative AI for the banking enterprise

Publicis Sapient's approach to Generative Al concentrates on nine categories where businesses can make progress:

- Creating new offerings

- Personalizing and creating comms

- Personalizing and creating content

- Focusing on conversations with the customer across channels

- Co-piloting for colleagues to improve the quality and productivity of tasks

- Automation of business processes and ways of working

- Product engineering and the software development life cycle

- Controls and protection for governance, fraud protection and guardrails

- Insights and decisioning to support strategy formulation

Pinak explains that Publicis Sapient takes an enterprise diagnostic approach to developing an Al suitability score to look at the drivers and barriers before identifying the critical use cases an organization should focus on.

"In parallel, you need to start creating a Gen Al platform by selecting your public LLM models and prompt engineering tools. And then, after getting hold of all your data, you build an enterprise conversational platform to interact with the LLM models.

"We then work on fine-tuning those models with plug-ins, and applying guardrails and content filters, before creating reusable libraries and prompt completion histories. Finally, we apply user analytics, operational analytics, model testing and experimentation, not forgetting there's always a human in the loop."

Continuous learning with AI

Pinak urges the need for centers of excellence to build Al capabilities across financial institutions: "We fundamentally believe in a continuous learning mindset. And we have a specific program called Espresso delivering exactly that.

The goal is to ignite curiosity for new topics and share what's happening across the industry. We focus on unlearning some of our bad habits to make sure our people are up to date and ready to support and enable our clients."

Modernization and simplification: A dual process

"It's easy to create something greenfield," says Pinak. "The issue is how to integrate that back into your legacy. How do you do your ledger reconciliations, risk or treasury integration or integrate back into identity and access management?

"How do you engineer genuine integration with existing systems? These are the nuances of modernization. And once you modernize, how do you go that last mile with the decommissioning of legacy systems?

"Simplification has to be an integral part of the modernization process so we properly address tech debt embedding decommissioning as part of the overall lifecycle."

Pinak Kiran Vedalankar , GVP Technology, Publicis Sapient

Lloyds and Publicis Sapient: The impact of our partnership

Spending insights

With challengers relying on traditional "systems of record", LBG and Publicis Sapient came together to deliver a "Transactions System of Engagement" (SoE), bringing data and insights directly to our customers and colleagues to provide enriched, personalized experiences.

Digital business account opening

This end-to-end, mobile-first proposition for Business Commercial Banking meets diverse customer needs, minimizes colleague manual handling and reduces account opening times from up to 30 days down to 48 hours, increasing conversions, and improving revenue, cost and NPS.

A pioneering, customer-facing journey on GCP

Digi++ marks a significant milestone as the first customer- facing journey to go live on Google Cloud Platform (GCP), granting eligibility to customers to access the Save & Invest feature.

Catalyst for core banking modernization

Publicis Sapient's innovation extends to the delivery of SOLVE as the first business proposition on Thought Machine. With this, Thought Machine emerges as a live and integral component, underlining its capability to facilitate Lloyds Banking Group's ongoing digital evolution.

Your credit score

An innovative collaboration between LBG, Publicis Sapient, and TransUnion, "Your Credit Score" is a credit-coaching product aiming to educate customers, boost engagement, and support them to meet their lending needs.

API management platform

LBG and Publicis Sapient collaborated with Google to design and implement an API management platform on GCP aligned to LBG's API strategy, using the latest features of Google's Apigee X platform.

Safelists

With millions of pounds being lost each year to payment fraud, Publicis Sapient partnered with LBG to implement "Safelists", a list of pre- validated account numbers of trusted HMRC accounts. With intuitive digital journeys, and targeted positive friction to educate customers and prevent them from becoming victims of fraud, this resulted in a 95 percent reduction in this type of fraud.

Modern Engineering

A transformation catalyst for Lloyds Banking Group

In this exclusive conversation, Publicis Sapient’s GVP Technology, Pinak Kiran Vedalankar and Peter Crouch, Engineering Lead, Consumer Servicing at Lloyds Banking Group, explore the impact and practices of modern engineering.

Related Readings

-

![]()

Solution

Core Modernization: Unleash Your True Potential

Legacy core holding you back? Future-proof your business and accelerate your innovation with a modern cloud-based core system.

-

![]()

Solution

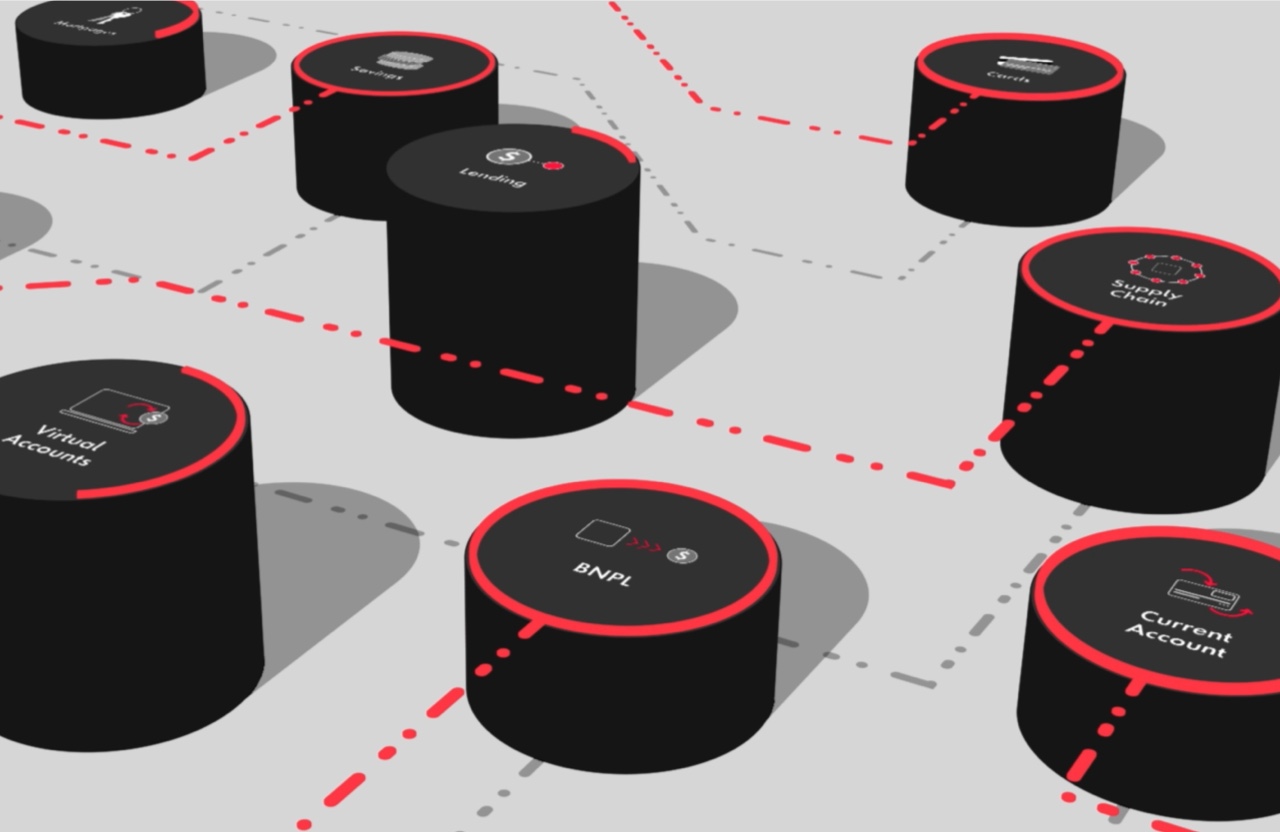

XBank: Build a Neobank, Fast

Design, build, launch and scale new banking products and services at speed.

-

![CAP Promo image]()

Solution

Speed Your Journey to the Cloud

Discover the Cloud Acceleration Program - helping financial services firms build a Google Cloud foundation faster.