What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Web3: The Next Generation of the Internet. The Race is On

Web3: The Next Generation of the Internet. The Race is On

Decentralized finance (DeFi) disrupts traditional financial services--but planning now for the internet's transformation can help banks stay ahead and create new opportunities. Here's how financial service companies can best embrace the future of the internet with Web3 and the Metaverse.

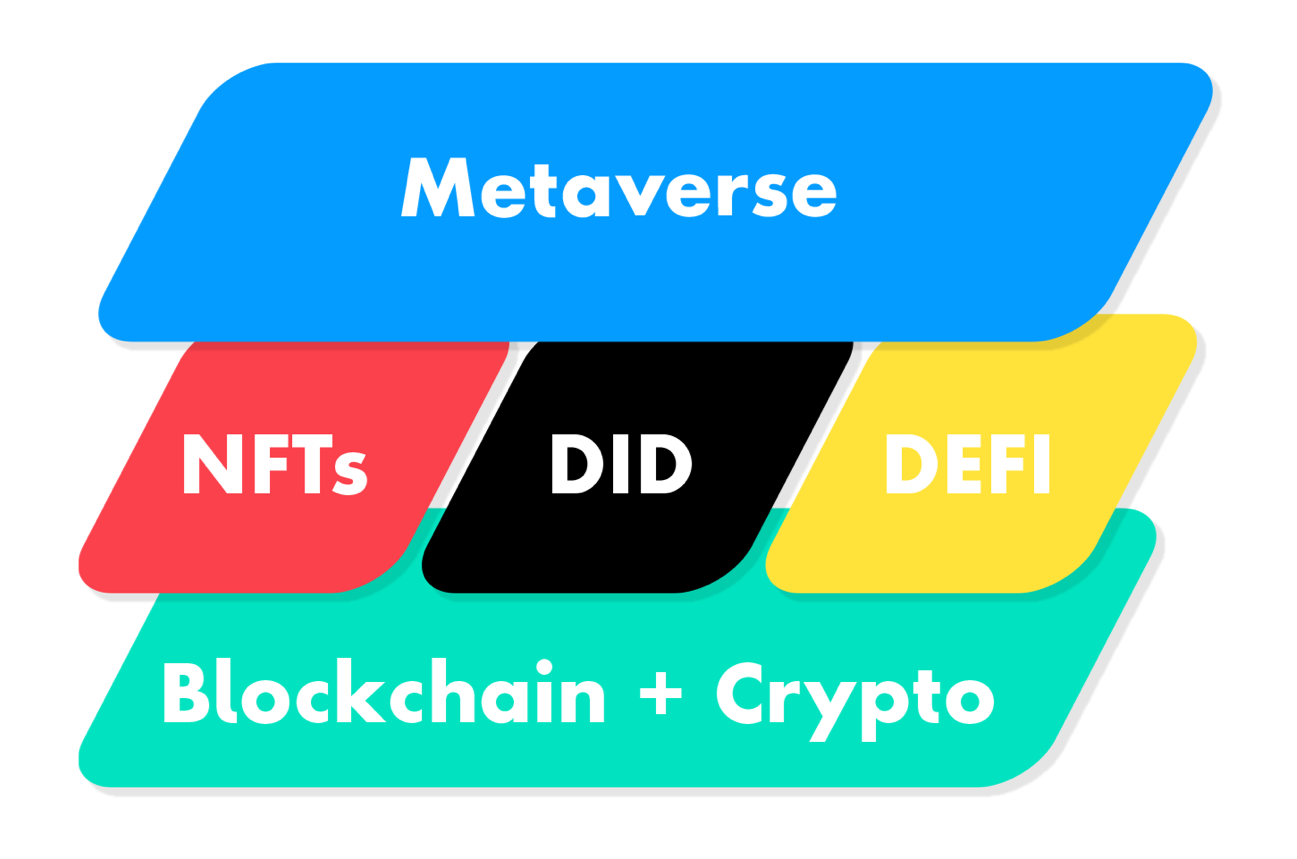

The New Landscape of Web3: “The Sandwich”

Sandwich Description copy: The Metaverse is the next-gen of connected experiences, merging technology like NFTs, DID, DeFi, blockchain and crypto to create new ways for people to digitally engage with the web.

A new form of internet is emerging with the introduction of Web3 and the metaverse. These allow us to move away from the fragmented interactions of today into the immersive experiences of tomorrow.

What can we build together? Think bigger—solutions like blockchain platforms, Web3 ideation,crypto-wallets and NFT marketplaces. With greater control over personal data and decentralized data storage, Web3 and the metaverse are critical components in how businesses will implement their digital strategies.

The possibilities of Web3 and the Metaverse

See how financial service companies can embrace future technology in great capacity:

-

![]()

Insight

Three Ways Banks Can Embrace the Metaverse Economy Now by Dave Donovan

The metaverse is set to change crypto and DeFi. Discover three ways financial organizations can get ahead.

-

![]()

Insight

Are You Gen Z Ready?

Who are Gen Z? What is their relationship to money and how are they banking?

-

![]()

The HOW Channel

Gen Z and The Next Generation of Banking

Instead of spending, Gen Z is saving—but when it comes to choosing a place to keep their money, not all financial institutions pass the vibe check.

-

![]()

Solutions

How Can Digitization and Blockchain Improve the Home Equity Underwriting Process?

The speed and efficient processing of HELOCs could be greatly expedited with digitization efforts.