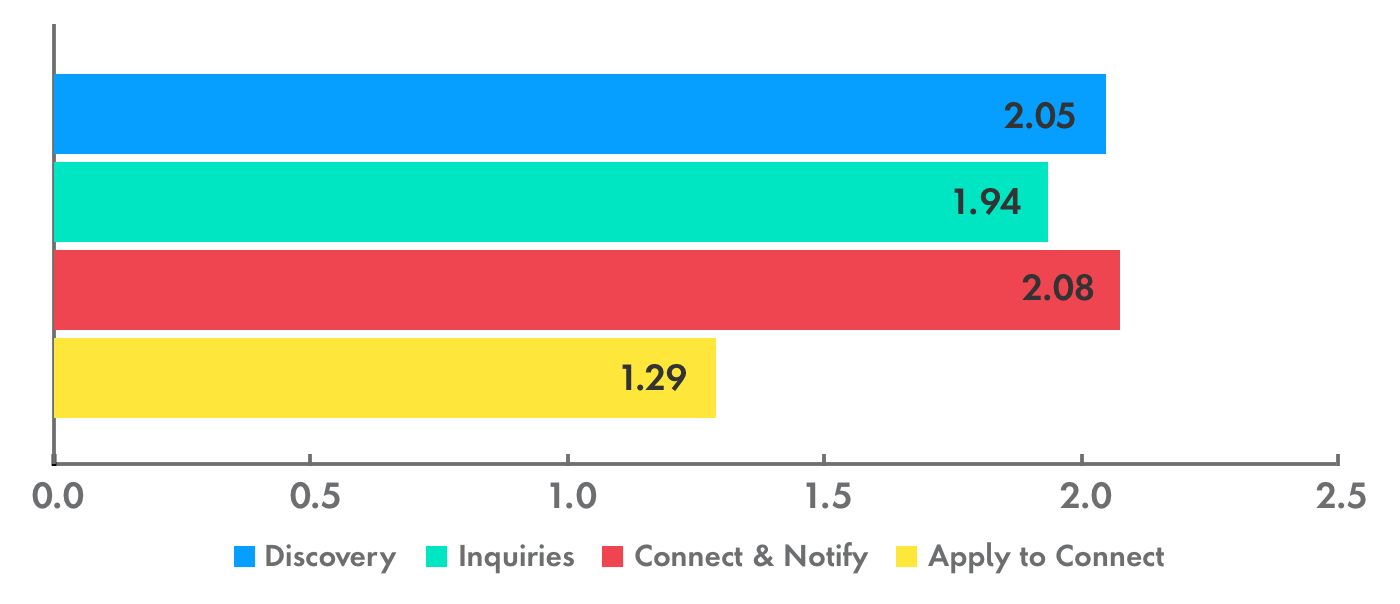

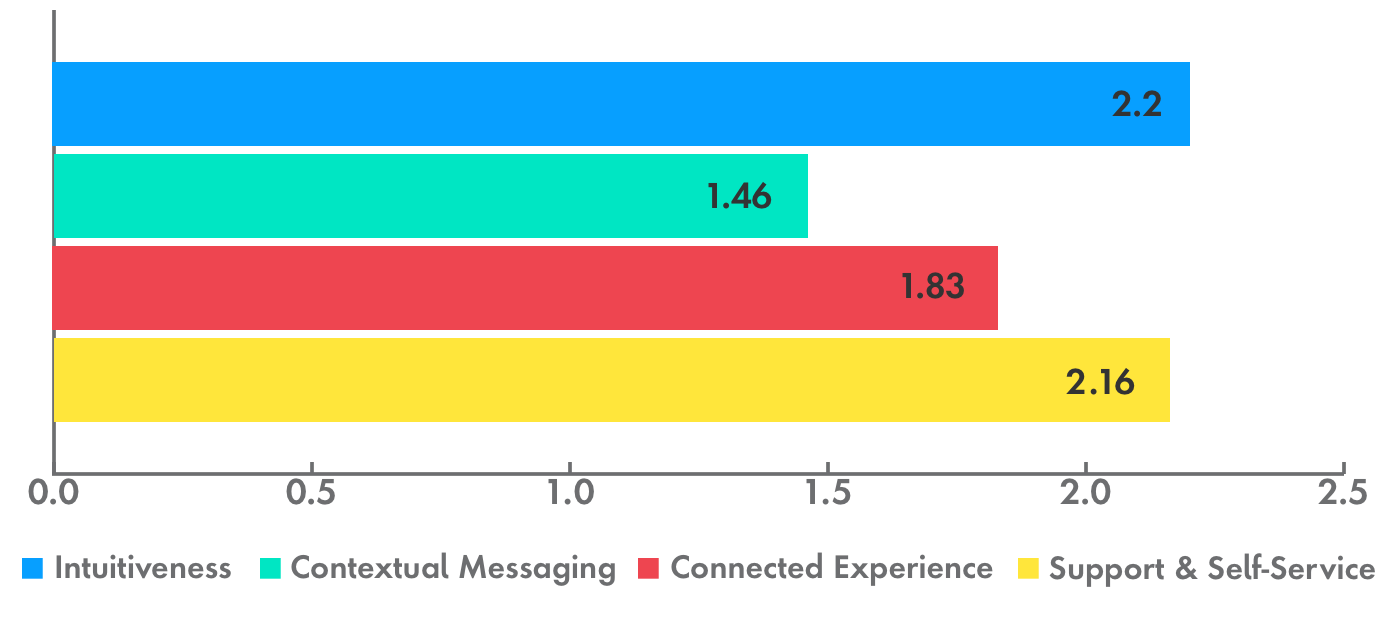

Analysts scored each criterion on a scale of one to five and considered everything from the ease with which customers access online forms to the clarity of calls-to-action and the utilization of third parties to gather installation information effectively.

Again, UKPN received the highest marks. Overall, DNOs performed strongest in Intuitiveness and Support & Self-Service, since most websites exhibit a modern interface with easily accessible contact information.

However, organizations gave customers a fragmented and ambiguous experience by:

- Cataloging forms inconsistently across the website

- Lacking transparency regarding connection costs, processes and messaging

- Employing multiple touchpoints that do not meet customers’ needs

- Lacking helpful digital tools; e.g., webchat, cost calculators, etc.

- Lacking product and service recommendations

- Lacking wider ecosystem connections to adjacent services; e.g., EV manufacturers

Overall, the scores from both categories highlighted where DNOs can grow, such as by creating opportunities for personalized messaging or making service recommendations for customers. Based on the scores, analysts offered recommendations for meeting customers’ needs and building integrated journeys. Those recommendations fell under two categories:

Tactical changes: What should DNOs do immediately or in the short term to fix “hygiene factors” to ensure that journeys meet minimal customer expectations?

Strategic reinvention: How can DNOs ask and address larger questions about their role in processes and the bigger plays that they should consider?

Tactical changes provide quick fixes

The comparative analysis identified some pain points that tactical changes can alleviate. These are largely hygiene factors that are easy to identify and relatively simple to enact:

- Fix the basics: Ensure web forms utilize third-party information to accelerate the form-filling process (e.g., address lookup) and consider project accessibility for a diverse customer base.

- Digitize processes: Embrace green business processes and streamline paperwork for customers by replacing offline documents with basic web forms.

- Localize relevant FAQs: Use localized and specific FAQs alongside each stage of the process to help customers complete required information as they enter a complex space.

- Offer transparency: Provide price quotes in line with customer expectations so that they understand their options based on needs and resources.

- Follow up: Set expectations with customers to arrange the next steps according to a clearly articulated timeline.

As quick, simple fixes, tactical changes will not be enough to sustain the kind of transformation that DNOs need to meet the challenges facing them. Organizations should also consider strategic reinvention to fully integrate and digitize the customer journey.

Connect with customers more effectively with strategic reinvention

To simplify processes and enhance utility customer engagement, organizations should identify, execute and scale digital journeys by strategically reinventing their services.

Integrated journeys put customers first. DNOs should identify opportunities for bespoke journeys for either residential customers or the installers who work with them. This will optimize messaging, content and recommendations that can help customers and installers navigate the connection journey. All journeys should be simplified and fully digital to support integrated installation processes where customers and installers can schedule, manage and pay for requests in a single place.

How can DNOs build bespoke, simplified and fully digital journeys? They can follow the lead of other sectors, which set customers’ expectations for how journeys should unfold. DNOs thus have an opportunity to learn from these organizations and reinvent the utilities customer journey. Some best practices include: