What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Transportation & Mobility

Automotive Retail Transformation Starts From Within

Automakers are shifting focus beyond manufacturing vehicles to designing customer-centered retail experiences.

In the future, automakers will increasingly sell direct to consumers and provide post-sale services and support. With direct access to consumers, Original Equipment Manufacturers (OEMs) must develop the capabilities to deliver seamless, end-to-end, data-driven experiences.

Navigating this retail shift requires OEMs to transform their entire organization, not just parts of it. Here are three key areas to consider when modernizing the automotive organization:

1. Adopt a service design mindset

In the automotive industry, “service” typically refers to repair and maintenance activities, such as oil changes and tire rotations. However, in the next few years, the definition of service will expand beyond the domain of traditional car repairs.

In this new context, “service design” refers to the orchestration of a service layer—the customer experience layer that ties together hardware, software, online channels and offline channels to deliver high-touch, high-value retail experiences to customers.

Many luxury brands, including Tesla, BMW, Daimler, Cadillac, Audi and Porsche, are leading the way in innovative service design focused on the showroom experience, vehicle insurance and financing, electric vehicle (EV) charging, predictive maintenance and more.

A service design mindset enables OEMs to design a global retail experience.

A global retail experience

Dealers have traditionally set the tone for the car buying and ownership experience. They’re knowledgeable about local markets, and they know their customers well.

As retail becomes increasingly digital-first, OEMs must take the lead in designing a retail experience that is global, simplified and data-driven. To do so, automakers must understand macro purchasing patterns and changing customer behaviors in order to create a modern retail experience.

A redesigned retail strategy serves as the backbone for localized retail experiences adapted to fit certain regulations, markets and competitive landscapes.

For example, local regulations determine the level of dealer involvement in the purchase process. Competitive landscapes determine the appropriate experience customers expect for different vehicle segments and brand-specific value propositions.

Additionally, OEMs with different and/or competing brands under the same portfolio will need to consider service differentiators that define each brand, particularly as these brands work with the same product assets.

Define new patterns of selling with data-driven experimentation

Today, few cars are being bought online, and much of the automotive industry is in a phase of speculation. Few examples exist of what the future purchase and ownership experience might look like.

As a result, organizations are looking outside the industry for references to guide their efforts. But these comparisons may not be entirely helpful given the nuances of purchasing a vehicle online.

Most likely, automakers will uncover a third way that’s not yet defined but will be uncovered through data-driven experimentation. This involves a spirit of constantly looking at data and experimenting, without being too absolute in defining new patterns of selling, as the auto industry continues to undergo layers of transformation in the coming months and years.

2. Co-create a new path forward with all actors involved in the purchase journey

In the future, OEMs will have more direct access to their customers, with dealers taking on a consulting-oriented role and providing onsite support. This requires OEMs and dealers to co-create a mutually-beneficial path forward.

Without the need to manage inventory, offer incentives or advertise, dealers will shift focus from sales to service. Dealer staff will play a key role in supporting customers throughout the entire purchase process—from how they make consumers feel as they become new car owners to how much they can support customers post-purchase.

Assisted selling evolves through technology

In the coming years, OEMs will need to train dealer staff in presenting the right customer experience for each brand (particularly in a multi-brand dealership) and prioritizing long-term engagement over making the sale.

This could mean training and equipping dealer staff to offer virtual vehicle consultations, which some dealers offer today. In the future, this could entail immersive virtual experiences that inspire and inform consumers.

Much of the responsibility rests with OEMs to design retail experiences that enable the incubation and testing of new innovations.

Open data sharing across tiers

To deploy a more centralized retail experience, automakers will need to implement technical infrastructure to enable open data sharing between OEMs and dealers. This allows customers to configure, purchase and receive delivery of a car through any combination of online and offline channels.

Adding a layer of predictive intelligence enables OEMs and dealers to anticipate customer needs and reach out to customers proactively with recommendations.

For this new model to work, OEMs must work closely with dealers to define fair incentive models, ensuring that what customers gain in seamless experiences is not lost through dealer attrition.

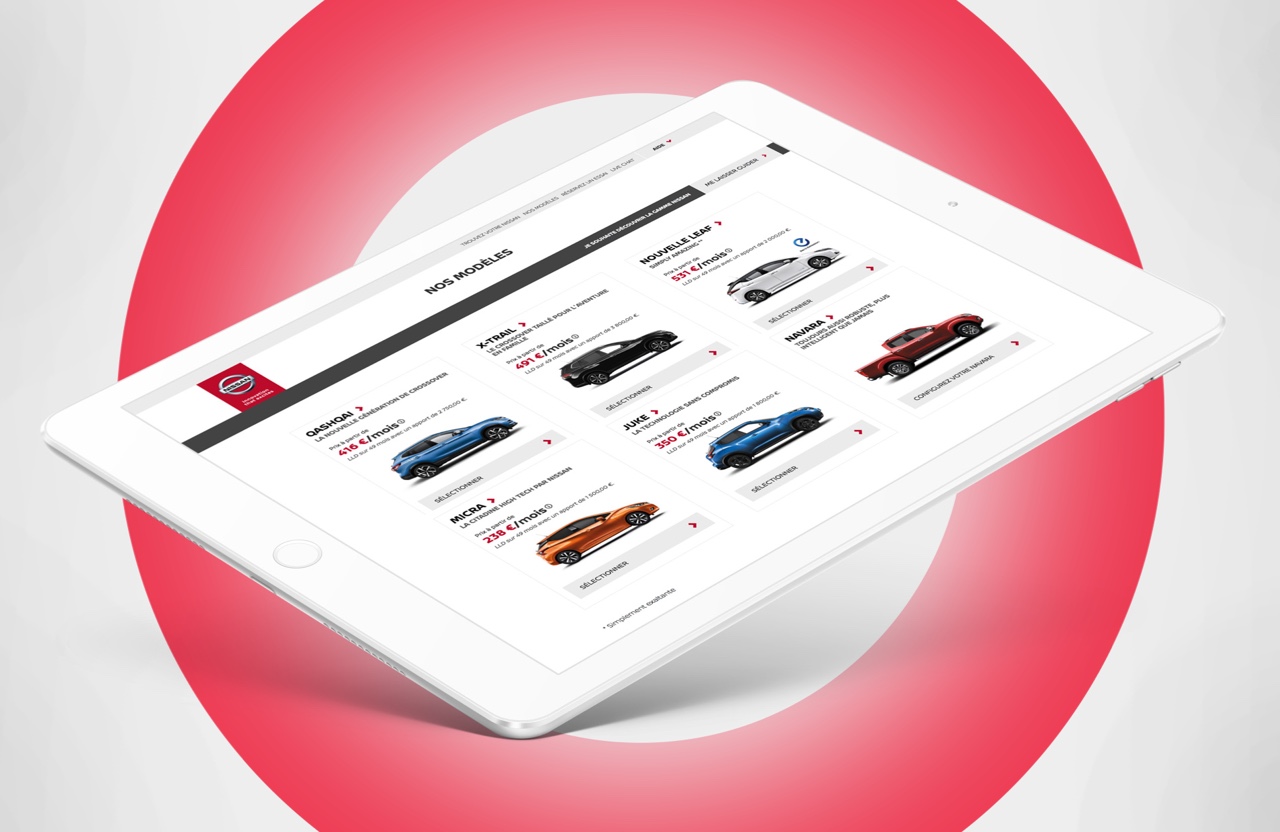

See how Publicis Sapient integrated Nissan’s data assets into a single retail platform

3. Advance new ways of working

The sales and marketing side of the automotive industry offers tremendous potential for transformation, as processes are often less structured than those on the product and manufacturing side.

An agile, integrated approach between sales and marketing will be key to innovating retail experiences. Here are two ways of working that teams can adopt:

Learn-by-doing using prototypes

Prototyping enables teams to see concepts in action, evaluate the complexity of experiences and observe how experiences integrate into existing systems—faster than traditional methods. This learn-by-doing approach facilitates faster decision-making and collaboration across stakeholders and internal silos.

Simplicity is a necessity when consumers must manage complex digital purchases on their own. Prototyping helps OEMs explore ways to simplify the purchase process, for instance, by observing how difficult it is to customize a car across 500 possible configurations.

Frameworks for feature prioritization

The move toward simplification in the automotive industry also means avoiding “feature creep.” Too often, when OEMs consider ways to add value, they can become focused on adding layer after layer of features.

The Kano model is a framework for prioritizing features based on consumer demand, which allows OEMs to refine customer journeys based on adding value rather than adding features.

Automakers risk investment in new ways of working. A pilot-led approach can be beneficial to corporations with less agile experience or with less appetite for risk, as quick wins can be achieved within individual units, thus building momentum for a larger agile transformation.

Looking ahead

To succeed in retail, automakers must swiftly adopt new mindsets, build dealer relationships and develop ways of working that place customers at the center of transformation efforts. This requires bold leadership and a commitment to reshaping the organization for a new and improved era of customer experience.

Related Reading

-

![]()

Article

How Automakers Can Transform into Tech Companies

With 5G hype at an all-time high, find out why today’s OEMs are functioning like data-driven mobility companies.

-

![]()

Article

Why OEMs Must Prioritize Customer Experience

Consider these four steps to build a loyal base of customers who can’t help but to stay in your brand’s ecosystem.

-

![]()

Article

Automotive Industry Future Sales Model

4 Approaches to Customer Experience, Loyalty and Value.