What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Transportation & Mobility

Unleash Captive Lenders’ Potential for Extraordinary Automotive Experiences

Customers who buy or lease vehicles want a frictionless, seamless, personalized experience from the one brand featured on the face or rear of their new vehicle. However, what they often get is a confusing, fragmented and frustrating experience that involves different companies with multiple brand names and interests. Why? Because in the legacy multi-tier industry marketing, distribution and service model, original equipment manufacturers (OEMs), dealers and captive finance companies (“captives”) are unaware of the ongoing customer interactions happening across and within their distinct entities, despite featuring a single common brand name and a stated aspiration for a unified experience.

While focus is typically on the challenges introduced by dealers or OEMs. It's important to recognize that captives also play a role in adding unnecessary friction to the customer experience. For example, a customer returns a leased car to a dealership at the end of the term, but the captive continues to bill the customer past the end date. Or a customer and captive have agreed to replace the vehicle due to warranty issues, but the OEM and dealer continue selling the customer accessories and software. These communication failures happen across a variety of customer journey stakeholders.

The root of this breakdown occurs as customer and vehicle data is fragmented and siloed, hindering the ability to cohesively attract, delight, retain and grow relationships and brand reputations with a customer while facilitating end-to-end customer experiences. No matter who the customer interacts or engages with, the brand’s perception, reputation and economic power to “charge more” is at stake.

Brand preference, by definition, drives customer satisfaction, advocacy and loyalty. To elevate the brand experience, it is critical for all the participating stakeholders to have a consistent view of a customer, no matter how fragmented their data.

Connecting data to supercharge seamless customer experiences

Given the massive volumes of customer and vehicle data being held by automotive enterprises, customers demand that their data be used to empower transparency during shopping, efficiency amid the sales process and cost savings on maintenance while they enjoy the ownership of the vehicle. However, the ecosystem of vehicle sales and ownership is typically owned by various players, resulting in disconnected experiences.

Complexity is compounded as customers engage with this variety of players through a range of touchpoints such as digital channels including web and mobile apps, at the dealership, via tools that enable a co-browsing experience and with customer service agents across devices.

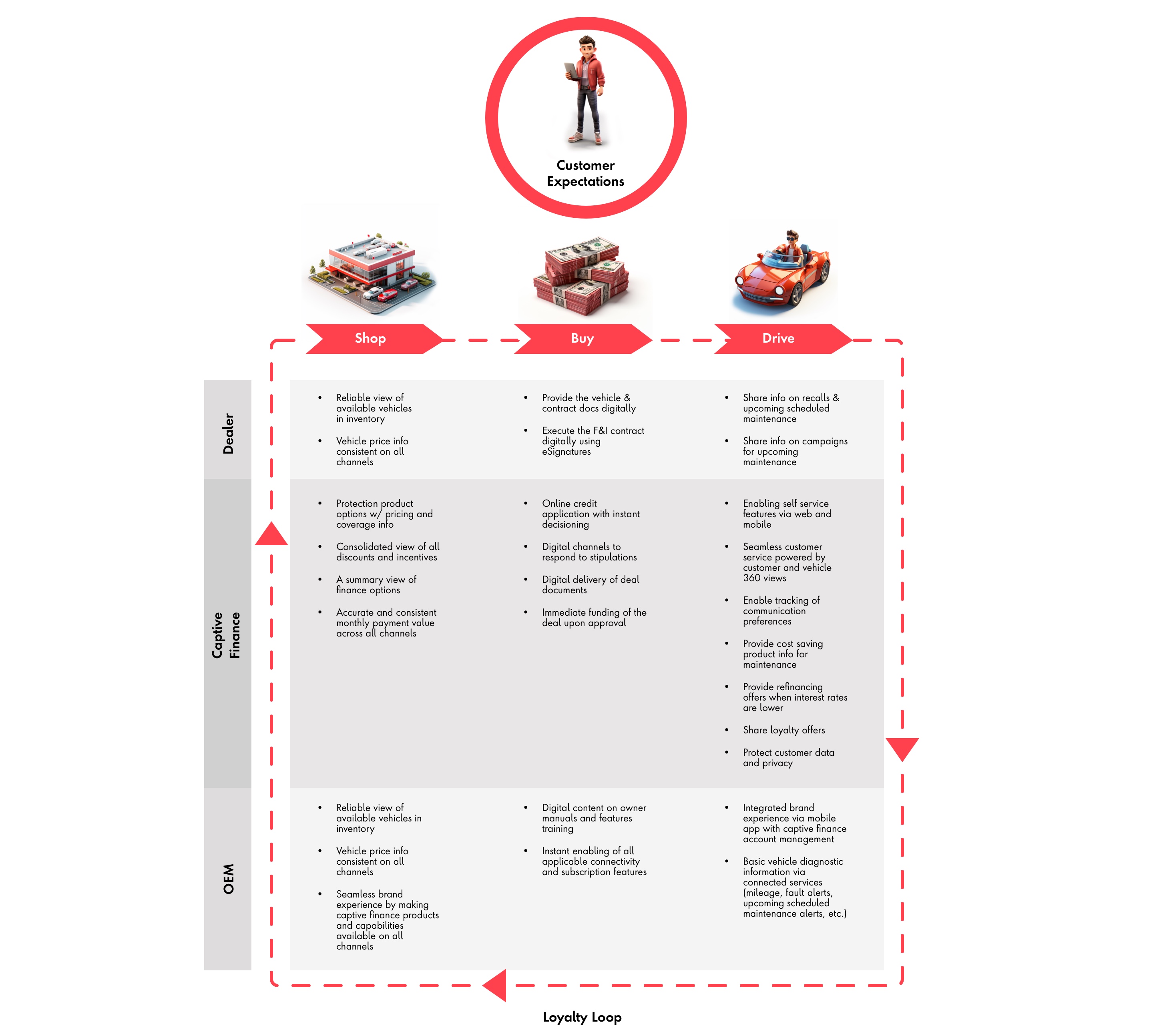

This diagram illustrates the ecosystem players and the respective customer experience processes they traditionally “own” or act as a steward.

Loyalty loop between OEM, Captive Finance and the Dealer

Today’s customers expect these experiences to be seamless and consistent, and the best way to do that is a comprehensive and integrated data strategy from each player in the engagement model. Quality and consistency enhance trust in the brand. With informed data strategies, these stakeholders can use the most relevant information available to help contextualize interactions and deliver consistent experiences, despite their differences in role and structure in the ecosystem.

The data strategy to make it happen

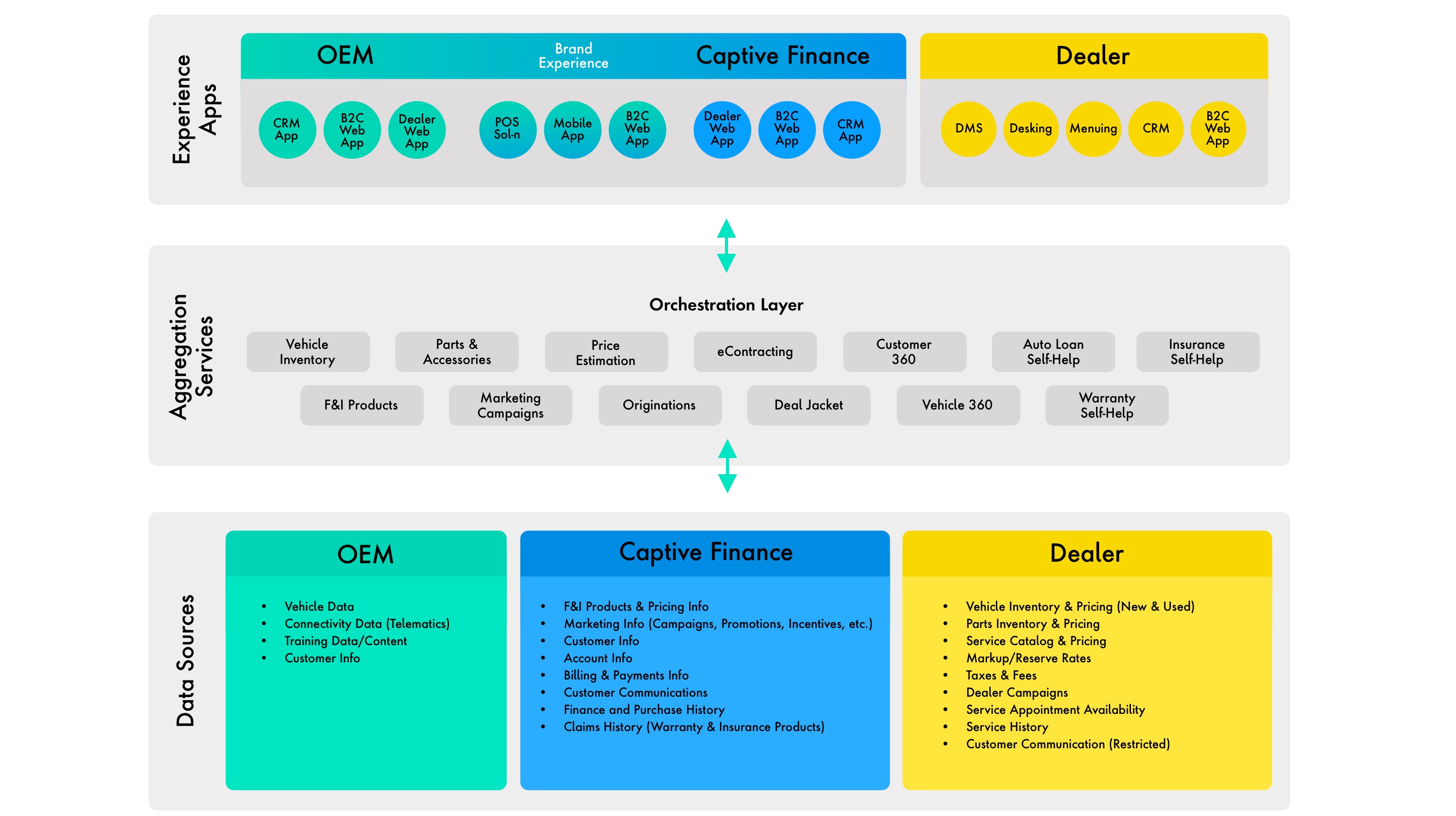

To elevate experiences, all customer-facing applications and professionals (including dealer employees and customer service agents) must be able to draw on customer insights from the data that exists across enterprises. This requires orchestration. See below for a conceptual view of an orchestration layer that provides data aggregation services for specific scenarios to all relevant channels.

How data sources integrate with distribution between OEMs, Dealers and Captive Finance

Given that changes to the legacy multi-tier marketing and distribution model will be gradual for most automotive enterprises, what can be done now to unify data and experiences? And who should build this orchestration layer?

Considering the interaction volume that captives have with the customer and their unique vantage point as a connector across organizational silos and vehicle and customer lifecycles, captives should play a leading role in orchestrating experience for the customer. And for vehicles that are not financed by the captive, there remains an opportunity to play this role, such as when a customer secures an extended warranty or other protection product from the captive as a similar data exchange is also executed.

While there is an argument that the captives should lead this orchestration layer due to the early exchange of a wealth of customer data, it is key that all ecosystem players come together in this orchestration effort. The customer journey should be designed collectively, but modularly, by each player to accommodate a variety of channels and unique variations and dimensions, while still providing a cohesive lifetime of connected customer journeys.

Overcoming challenges to data integration

While a data strategy that connects the range of automotive entities is critical, it also needs to address some unique data-centric obstacles to unifying experiences. These include:

Coming together for customer experiences

To provide a cohesive and consistent brand experience, OEMs and captive finance companies need to partner with their dealers around data strategies and orchestration capabilities so that all customer interactions are based on the same access and insights to common customer data and journeys with appropriate boundaries for the unique roles of each player. Such consistency will improve customer experiences, create profitable opportunities for all ecosystem partners and drive brand loyalty.

This move will require data sharing and appropriate agreements, an orchestration layer and investment in dealer experience assets to enable third-party applications to benefit from the orchestrated data. Captives are in a unique position to play the catalyst role in these efforts in conjunction with their OEM and dealer partners.

Publicis Sapient is a recognized global leader in digital business transformation for enterprises across transportation and mobility, financial services and a range of industry verticals. Our unique client success in data transformation empowers extraordinary customer experiences across OEMs, captives and dealers and delivers bottom-line impact for automotive enterprises. When you are ready to streamline and monetize your customer journeys, we combine unique capabilities from strategy to delivery to successfully get you there.

Work With Us

Are you ready to begin your journey to a new era of value and profitability?

Let’s get started.

Related Reading

-

![]()

Insight

Collision avoidance: Why Motor Insurers Will Need to Embrace Partnership-Driven Propositions

Digital disruption is signaling an uncertain future for traditional motor insurance business models. How can insurers seek critical partnerships to keep their competitive edge?

-

![]()

Case Study

How a U.S. Insurer Is Driving Growth Through Customer-centric Thinking

Learn how one insurer’s journey transformation program delivered an extra $5B+ in revenue. Find out more.

-

![]()

Insight

From Automaker to Ecosystem Driver: 4 Stages To Orchestrate a Digital Mobility Ecosystem

To develop, deploy and evolve an ecosystem of digital and mobility offerings, there are four stages automakers must go through.