What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

Transforming Big Oil Through a Customer Data Platform (CDP)

Transforming Big Oil Through a Customer Data Platform (CDP)

How industry leaders can capitalize on existing margins in O&G.

Technology and the industry

Oil and gas companies must get to know their users. Their future depends on it. As legislation, consolidation and competition drive digital evolution, the O&G industry must accelerate along the digital maturity curve.

All businesses must be data independent, and O&G companies are no different.

A customer data platform (CDP) helps companies tap into their users’ digital identities. However, companies must go further and reach people based on their level of digital nativity or privacy sensitivity. Companies can thrive if they distinguish themselves as reliable, professional, and ethical through the protection of their users’ privacy. They can do this by sharing how they use data and listening to consumers.

A digital identity is commonly defined as an online identity assumed by an individual, organization or electronic device. Users can adopt more than one digital identity through multiple networks and communities. When it comes to the management of digital identity and the data these profiles generate, security and privacy are key concerns. Legislation is subject to change – in the U.S., states are creating their own privacy laws and federal governments are adopting new measures, with California’s landmark California Consumer Privacy Act leading discussions.

In the big oil industry, CMOs and CIOs work in a less digitally mature industry than, say, retail. As they adopt new technology, they must show how they gather customer information and how they use it. Building a robust and versatile CDP protected by a clean room is one of the best ways to protect customer data and deliver distinctive digital experiences. Defined as a secure, isolated platform1 that links anonymized marketing and advertising data from multiple parties, a data clean room combines advertising impression data sets with privacy-safe restrictions.

What’s keeping O&G industry leaders awake at night?

The global energy transition is moving forward, and O&G leaders with carbon zero targets have to deal with new pressures. While there are many aspects of the energy transition, this article focuses on CMO and CIO concerns specifically and how a CDP can help anticipate and solve challenges. Electrification and activist investors are top concerns pressuring O&G organizations from the outside, while data management represents an internal pressure for industry leaders.

As the world becomes electrified, overall oil demand will plateau and start declining — the so-called peak oil effect. This is likely to occur in the next 10 years in Asia, and within five years across Europe and the U.S. Europe is starting at a smaller rate of decline per capita, as many cars are already equipped with smaller engines. Ford announced that its entire passenger range in Europe will be electric by the end of the decade2. The U.S. will see a more dramatic decline. General Motors plans for an “all-electric future” by 20353, implying that in the next five years, at least 25 percent of its total car output will be all electric.

ExxonMobil recently committed to cutting carbon emissions from its upstream production business by 30 percent by 2025 and announced a new business unit dedicated to technologies that lower emissions.

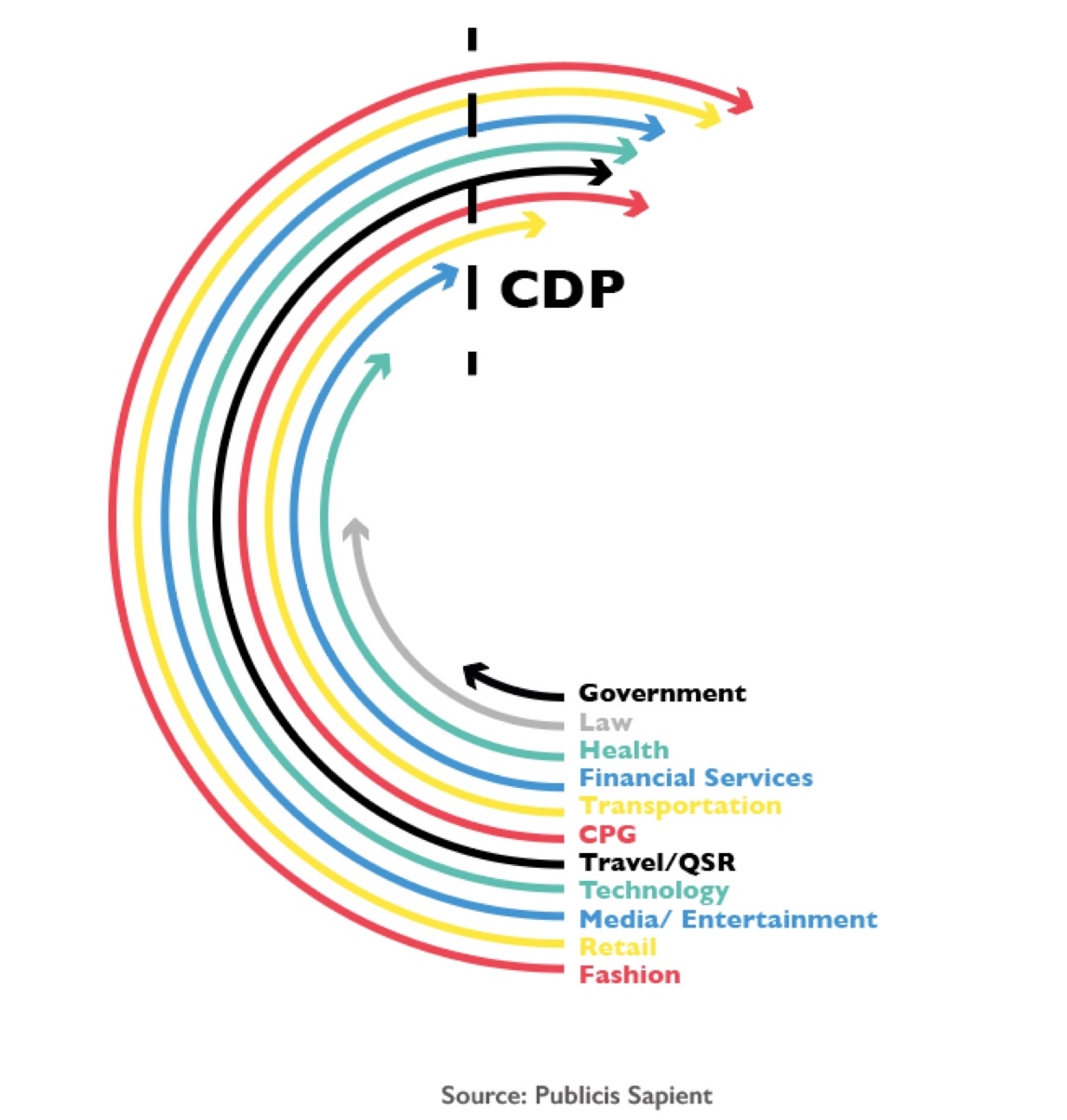

On the digital side, O&G starts from a position well behind other major sectors, notably banking and retail, which have undergone rapid changes over the past few years. In the PS digital maturity universe graph, O&G sits between government and law sectors.

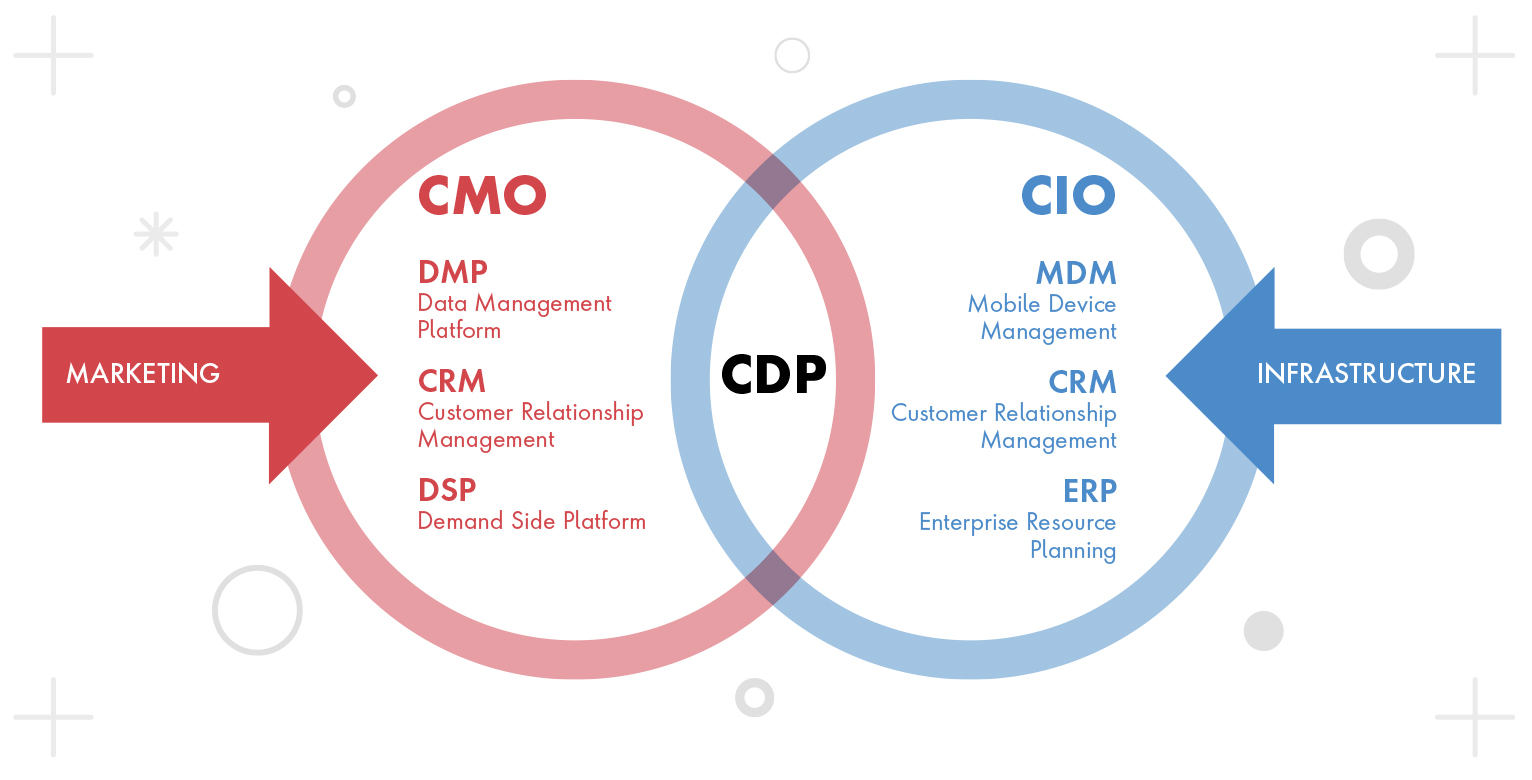

With marketing and technology infrastructure integrally connected through data, CMO and CIO are concerned with what data will look like and how to get ahead in the digital maturity curve.

CMOs fret about the death of the cookie. Tracking has been largely done by cookies, which allow websites to identify and remember users. Browsers and government regulation are banning the sharing of third-party cookies.

- CMOs fret about the death of the cookie. Tracking has been largely done by cookies, which allow websites to identify and remember users. Browsers and government regulation are banning the sharing of third-party cookies. New layers of technology offer alternative tracking solutions: think of operating system layers, browser layers, ISP layers or social network layers, search or ad exchange layers. A CDP can assist transition to a cookie-less world by aggregation, organization and alignment of customer data that can be used for marketing activation.

- CIOs worry about the rise of cloud and data protection. CPPA, ePR and GDPR legislation has come into force to protect the privacy of internet users. Cloud computing has made innovative products available, with the result that marketing is more layered than ever before with targeted, personalized and multichannel options. This makes data protection and collection measures more intricate and necessary. A CDP can offer support by sifting through customer data in a way that complies with privacy laws, for example, by applying identity resolution software on 1st party data to recognize the unique digital identities of customers.

Understanding data

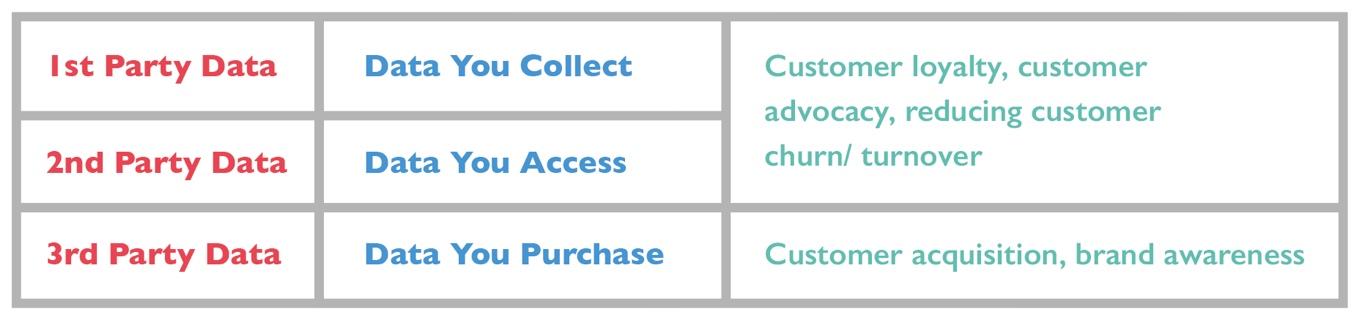

A CDP unites areas of concern for both CMO and CIO – like where the data lives. Data management systems record three kinds of data.

A CRM records and organizes 1st party data, and a DMP organizes and activates 3rd and/or 2nd party data. A CDP records, unites and activates 1st, 2nd and 3rd party data.

Databases in O&G

How can industry leaders in marketing and tech infrastructure unite to get customer touchpoints on one platform?

A CDP is more than just a CRM and DMP. Gartner4 defines a CDP as a marketing system that unifies a company’s customer data from marketing and other channels to enable customer modeling and optimize the timing and targeting of messages and offers.

A CDP is more than just a CRM and DMP. Gartner defines a CDP as a marketing system that unifies a company’s customer data from marketing and other channels to enable customer modeling and optimize the timing and targeting of messages and offers.

According to research from Publicis Sapient and WBR Insights new privacy and compliance regulations are driving companies to plug into CDPs. The report surveyed 100 leaders at director level and above on how they are using CDPs to better understand their customers. Findings revealed that respondents without CDPs are having less success than those who have adopted one.

CDP as the solution

For B2B leaders, CDP use cases include account-based marketing (ABM), advertising efficiency, personalization and orchestration and data productization.

Data-driven ABM creates campaigns and understands the behavior and interests of the buyer collective within key target accounts to deliver highly personalized campaigns.

Advertising efficiency finds the right audience. Instead of canvassing a large population segment, organizations should look for specific audiences. A CDP can enable CMOs to apply campaigns to contextual demographics.

Personalization and orchestration connect with customers where they are. Orchestration is meeting customers where they hang out, through TV or social media. Personalization is offering relevant products and services. O&G organizations need to think beyond their gasoline or lubricant molecule to the overall experience of the customer. A customer may want a well-maintained car rather than a molecule. Organizations need to personalize packages for individual customers.

Data productization happens internally through customer service representatives, inside sales and digital self-service functions. When customers running heavy machinery or gas turbines repurpose or change business operations, a digitized sales process needs to be integrated to be B2B specific. Here a CDP becomes important because what each industry needs is different and can be personalized through a CDP.

Three things to focus on now:

1. Migrate to the Cloud – CIO

Elastic cloud native applications can save costs. Our research partnership with Petroleum Economist found that 79 percent of oil and gas organizations are using cloud-based services in their operations, and it was by far the most commonly adopted technology. The Publicis Sapient 6Rs of Cloud Migration helps CIOs analyze decision points of their business and helps collaborate with stakeholders. The framework assesses whether to retain, retire, re-host, re-factor, re-platform or re-purchase a company’s application portfolio. In this way, organizations can avoid high usage cost by choosing the right technology strategy.

2. Unify Customer Data – CMO

CMOs need to build an in-depth understanding of their customer and the intermediaries in the supply chain servicing those customers. This must be driven by the CMO’s office and requires an approach to sourcing and curating 2nd and 3rd party data in order to have a full 360-degree view of the customer. A CDP can break down data siloes, create visibility and give access to information.

3. Distinguish Between Data Engineering and Data

CIOs still confuse data engineering with data: they talk about data, but what they are really talking about is data engineering. Future data privacy laws will be most concerned with data that describes digital identities. Businesses will need to have a centralized area on the cloud where all customer data is matched against a single digital identity so that its source, location and access logs are known. A dedicated role for a chief data officer may sit under the CIO or CMO function, if needed.

Conclusion

O&G organizations need to know their users directly, be data independent and implement digital strategies. In big oil, this could be through launching digital and intelligent oilfield construction plans. ExxonMobil launched a partnership with Microsoft5 to use cloud technology and increase operations in its Permian Basin operations. Smart-Field technology by Royal Dutch Shell uses sensors built into field equipment, such as valves and pumps, to transmit data on temperature and pressure to control centers on land6.

To thrive beyond peak oil, O&G leaders should take a three-pronged approach. With shrinking markets, a CDP will help them to understand how to appeal to customers. Secondly, as businesses transition, they need to bring new services to market and reach customers in a personalized way. Thirdly, CMOs and CIOs must communicate their diversifications to customers.

Sources:

- https://us.epsilon.com/core-content/5-questions-on-data-clean-rooms-answered

- https://news.sky.com/story/ford-joins-motor-industry-race-to-all-electric-future-12220588

- https://www.nbcnews.com/business/autos/gm-go-all-electric-2035-phase-out-gas-diesel-engines-n1256055

- https://www.gartner.com/smarterwithgartner/marketers-to-guide-customer-data-platforms/

- https://corporate.exxonmobil.com/News/Newsroom/News-releases/2019/0222_ExxonMobil-to-increase-Permian-profitability-through-digital-partnership-with-Microsoft

- https://www.shell.com/energy-and-innovation/overcoming-technology-challenges/unlocking-oil-and-gas.html

Related Reading

-

![Fuel Station 2025]()

Fuel Station 2025: U.S. Q&A on World’s Largest Oil Market

U.S. fuel stations can use data to inform customer experiences as they focus on creating contactless and safer environments.

-

![Demand Capture]()

How Fuel Retailers Can Grab Market Share Through Personalization

Fuel retailers have a big opportunity to grab market share through personalization. This has become especially important as 2020 saw a drop in oil demand due to the COVID-19 pandemic.

-

![Big Oil Promo]()

Transforming Fuel Retail

How consumers, markets and competitors are driving the need to modernize big oil