What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Data-Driven Personalization: How to Increase Market Share and Generate Revenue

The Necessary Capabilities, the Right Technologies

The Necessary Capabilities, the Right Technologies

Right now, personalization is a huge buzzword in the financial services industry. Everyone is trying to unlock its promise.

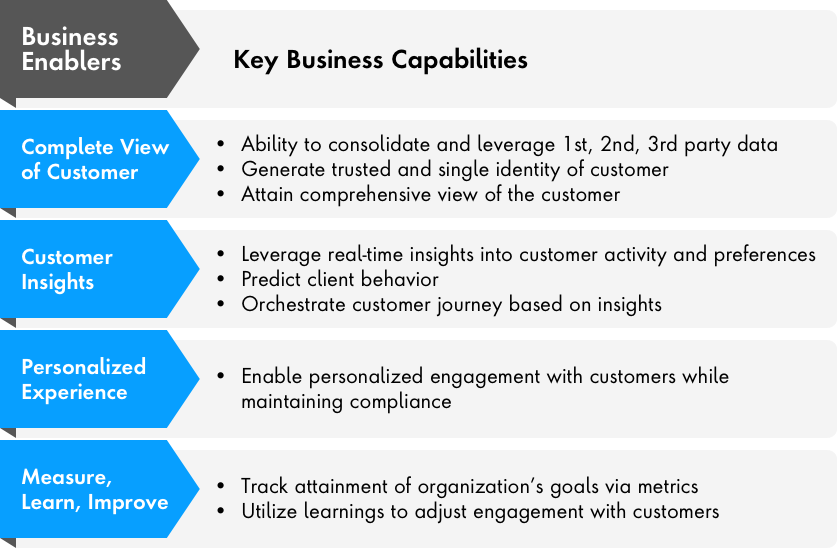

Publicis Sapient’s Brian Henning explains that personalization is ultimately an end-to-end set of business capabilities that provide a complete view of the customer, insights into their next likely action and the means for providing a highly focused and personalized experience based on their specific needs.

“Why on Earth would someone want to do this? It’s a lot of work, investment and time,” Henning said. “The answer: to achieve trust and secure loyalty from both existing and prospective customers. Banks that can achieve trust and loyalty, can translate that into substantial market share and revenue. That’s the end game.”

To improve personalization, Henning said it is critical to leverage a specific approach that starts with a business-oriented discussion, not technology. Specifically, organizations need to first identify whether they possess an end-to-end set of business enablers and corresponding business capabilities for achieving personalization. Through this exercise, organizations gain clarity on their gaps from a business standpoint.

Once an organization has evaluated their relevant business capabilities and identified their gaps, they can then determine where they have the underlying supportive technology and data or where they have gaps.

Armed with a knowledge of business and technical gaps, Henning said organizations can then properly prepare, invest and kickstart initiatives with the right focus, avoiding spending time, energy and budget on the wrong areas.

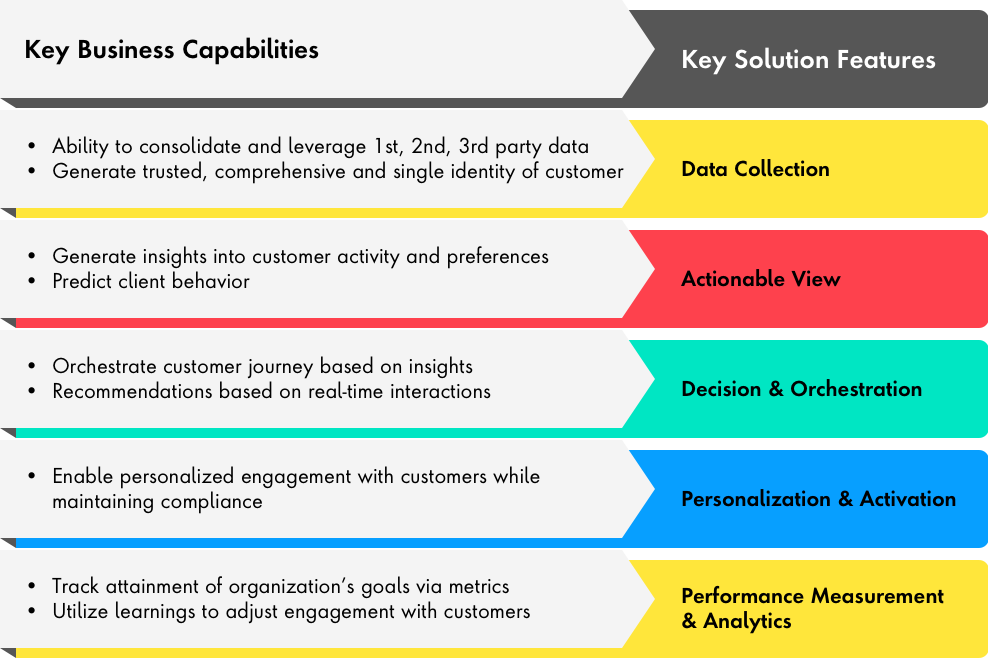

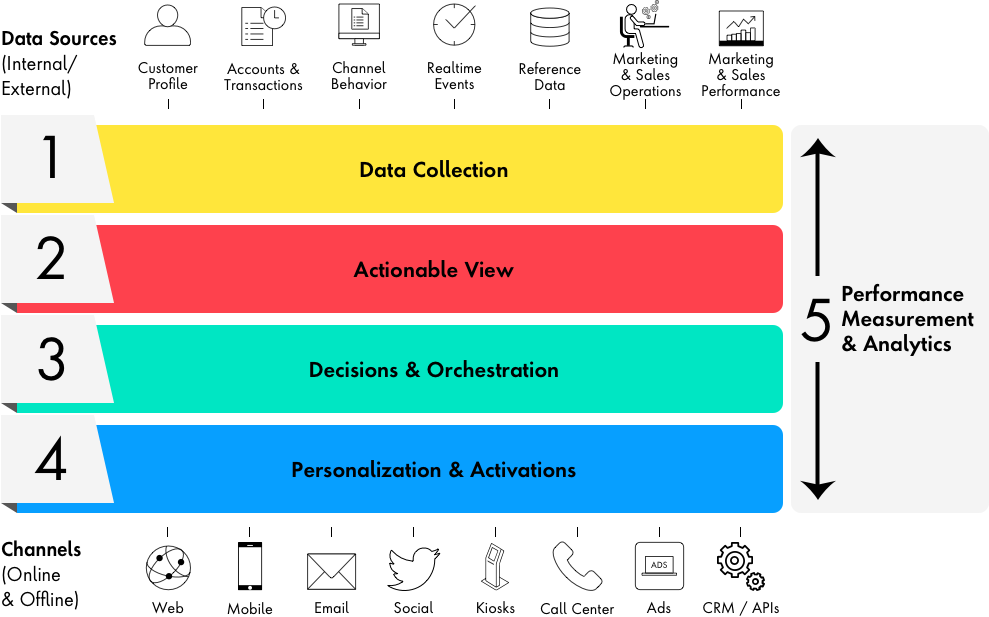

To achieve true personalization, the underlying solution must be holistic and integrated. A piecemeal or siloed solution will go nowhere. To accomplish this, banks need to possess the following key solution components:

- Data that is collected from relevant sources (e.g., customer profile, transactions, etc.) and consolidated for easy access.

- Specific proposed actions that will instigate engagement with customers based on insights from the data.

- A carefully orchestrated journey that is specific to each customer segment and audience

- Personalized content, communication and engagement with customers while maintaining compliance

- An iterative process that measures performance and effectiveness of campaigns, content and engagement. Personalization is never ‘one and done’, but armed with this insight, learnings can be leveraged to improve and optimize marketing spend.

Altogether, the solution looks like this:

“Do you have the right data and can you act on that data? Can you orchestrate journeys and send out the right engagement and personalization? Do you know what is working and more importantly what is not working? It is imperative that organizations address each of these areas but also do so in a way that is integrated and cohesive.”

With Salesforce enabling a complete and comprehensive view of the customer, banks can provide personalized and relevant information, offers and service at each step of every customer’s journey.

Familiar platform, novel solution

Salesforce originally focused on solutions to enable the sales and service functions within organizations. Over time, the Salesforce platform has grown significantly, with a very broad and deep set of solution that also address the needs of digital marketers and most importantly the customer themselves and their respective experience.

“Salesforce provides an end-to-end set of solutions that can fulfill the personalization needs of financial services organizations. These solutions are fully integrated and therefore easy-to-use for digital marketers. At times, our clients have already invested in non-Salesforce solutions for some of the personalization stack, but that’s OK. The platform is completely open which makes it easy for clients to leverage Salesforce to fill gaps and easily integrate with their existing technology investment.” Henning said. He further said, “the most critical piece is ensuring that all areas of the personalization stack and related capabilities are fulfilled and tightly integrated, otherwise the customer experience will be disjointed.”

Henning specializes in Salesforce-based professional solutions while his team enables financial services organizations to deliver purposeful and data-driven customer experiences at every step of the journey.

In practice, ideally a customer should receive a personalized communication about a product, service, or offer that is relevant and timely for them. No one wants to receive a boilerplate message from their financial institution that has no relevancy. That approach is not only wasteful but can be harmful to the relationship between a customer and the financial institution they want to trust.

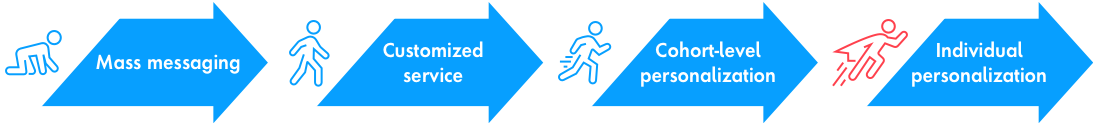

Henning said its critical for financial institutions to assess their existing maturity level for personalization, but more importantly highlight their desired target state and generate a specific plan and roadmap for getting there. With the right approach and methodology, organizations can evolve from applying a single set of messages to a broad market (mass messaging) to letting users make deliberate choices about their journey (customized experience) to tailoring an experience for an audience based on similar behavior and needs (cohort-level personalization) to ultimately engaging with each individual and providing a completely tailored experience based on the customer’s identity and related data that highlights specific needs (individual personalization).

“With meaningful data and insights, you can make better decisions and not only improve marketing spend, but also optimize all touchpoints with a customer including sales, service and external facing self-serving portals.”

The Salesforce advantage

Salesforce maintains a specific set of solutions for the financial services industry, that help businesses supercharge their transformation efforts with speed and agility at sale.

Marcelle Wall, a Director within Publicis Sapient’s Financial Services Salesforce practice, explained that Salesforce now provides a Financial Services-specific data model with Financial Services Cloud, and has added mid- and back-office capabilities for FS customers through Industries Cloud. “Salesforce is truly a trailblazer with their innovative approach to digitizing and automating business processes. That is where real value can be generated for the business and ultimately the bottom line,” Wall notes.

“Publicis Sapient is the first partner certified on Salesforce’s personalization platform, which includes solutions for identity, personalization at scale, and a customer data platform (CDP).”

As society becomes increasingly digital, financial services organizations will face new forms of competition. But the shift toward digital also means increased opportunity for change, differentiation and growth. Banks can best navigate and overcome these challenges if they identify the threats, confirm gaps in business and technical capabilities and generate the appropriate path forward. Salesforce can be an integral tool in financial institutions forging that path.

Want to learn more?

Let’s have a conversation about how Salesforce can help you with your personalization journey.