What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Insight

Are North American Banks Ready for Open Banking?

Are North American Banks Ready for Open Banking?

With the adoption of digitization and advancements in payments technology, the customer interaction model with financial institutions has evolved. An increasing number of customers are interacting with banks on their phones. Open banking harnesses this lifestyle change and improves the customer experience with increased transparency.

The global open banking market is expected to reach $43 billion by 2026 in North America. The opportunity is expected to register the highest compound annual growth rate of 26.5 percent during 2019-2026. Open banking opportunities can be harnessed across financial services (payments, wealth management and commercial banking) and distribution channels (apps, distributors and segregators).

What is open banking?

Today, as a customer, if we want to order food, coffee or even a ride, we sign up on the application, create a user ID, make a password and grant access to our banking information. This is how fintech or third-party providers access the information, called scraping. But we are exposing our financial data and increasing our risk of data vulnerability and identify theft.

With open banking, the financial institution agrees to expose the customer information through a secured application program interface (API), eliminating the need for customers to provide account information to individual third-party providers or fintechs. There are three types of APIs that exist in every FI’s ecosystem:

1. Internal APIs–These APIs are specific to every bank/financial institution and hold proprietary information, (e.g., an API that connects to internal identity and access management (IAM) systems).

2. Partner APIs–Financial institutions/banks establish these API sets for seamless integration for B2B operations. This enables real-time access to information and improved analytics.

3. Public APIs–These are the APIs that support open banking. Financial institutions can agree with third-party providers/fintech organizations to expose these APIs to enable access to customer data through a secure token.

Five ways open banking will benefit customers

1. Enhanced customer experience – The customer experience will be unified and seamless as the interactions will be specific to each customer lifestyle and their specific needs. As per the customer journey, they will be able to submit their requests without disrupting the journey by taking them to a financial institution’s page.

2. Cross FI experience – Open banking will enable cross-financial institution experiences, providing customers a blend of services.

3. Improved pricing options on financial products – Today, customers’ options are mostly limited to their financial institution. However, with open banking, customers will have the flexibility to choose the products from a variety of companies.

4. Enhanced data security – Financial institutions and banks will establish security tokens with third-party providers that eliminate the need for customers to reenter their username and passcode for granting access. This reduces data vulnerability and security issues that exist at every transaction level.

5. Improved decision making – Customers will have the ability to choose the best possible product among multiple financial institutions and third-party providers. They will help improve financial planning.

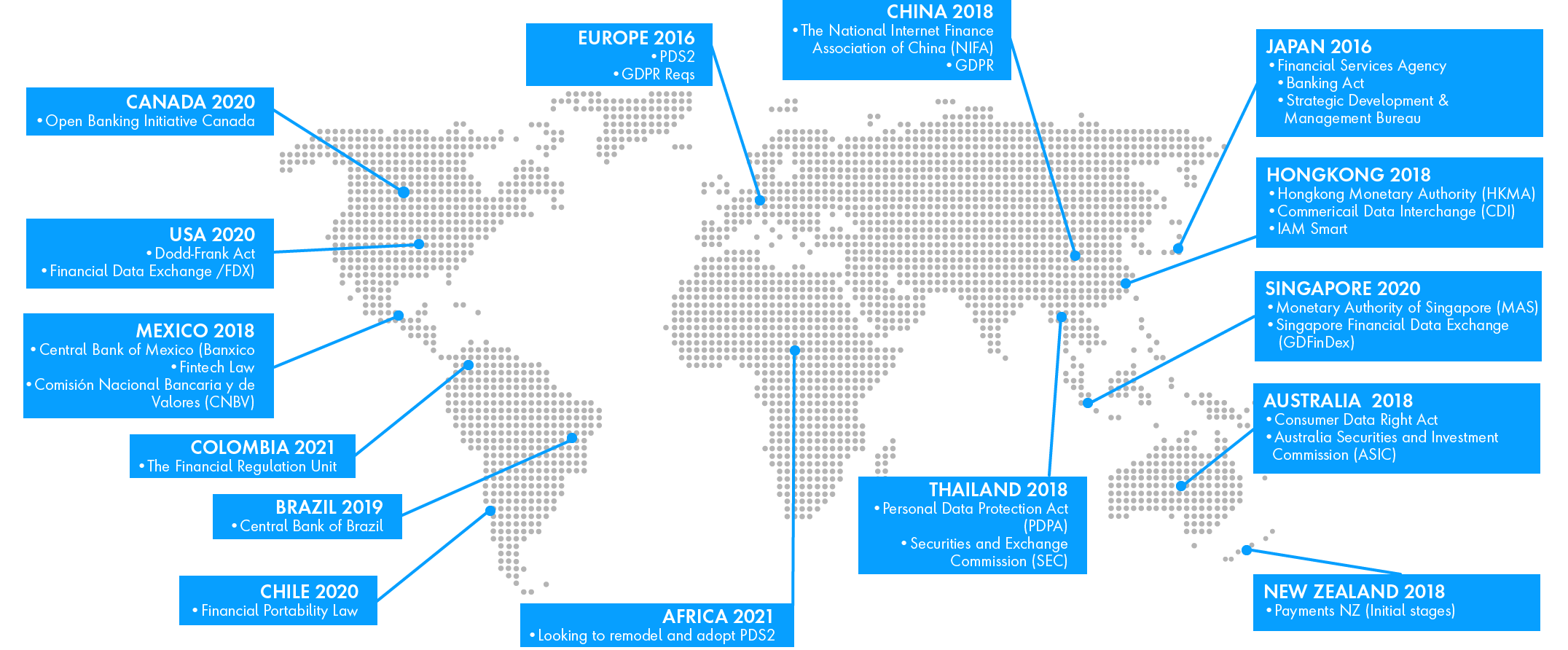

Open banking across the globe

For the successful adoption or open banking, customer data must be securely exchanged. Countries across the world have been establishing governance controls that enable sharing of customer information securely. The adoption of open banking has been largely driven by the establishment of data regulatory standards for the exchange of digital information

Opportunities for Banks and FIs

There are several opportunities across all lines of business for banks/financial institutions to innovate and differentiate through open banking. The big-ticket use cases in open banking are in customer onboarding, customer identity validation, payments, money movement, commercial banking and cash management (financial planning).

To be able to harness the benefits and mitigate some of the challenges of open banking, financial institutions should proceed with a step-by-step approach: initiation, progression, transformation and differentiation.

Evolution of API Development to support key use cases in Financial Services

What should banks do to harness open banking opportunities?

Financial institutions must revisit their strategy, operating model and API implementation to build seamless experiences for customers. With the evolution of open banking, the capabilities that existed traditionally in banks’ silos will be decentralized, distributed and accessible to multiple stakeholders. They must look at each interaction as an independent journey with different third-party service providers.

To prepare for the next evolution in financial services, banks should take the following steps -

1. Define the business strategy – Understand the differentiation strategy for all lines of the business. Determine the different roles (i.e., influencers, contributors, coordinators and fulfillers) that third-party providers or the bank will play in this new evolved ecosystem.

2. Identify use cases/customer journeys – The next step is to determine foundational use cases/customer journeys (e.g., customer identification and validation, applicable to all lines of business) and core use cases/ customer journeys (e.g., credit expense management) specific to each line of business to differentiate customer experiences.

3. Define delivery methods – Understand when the bank will deliver alone or in partnership with fintechs. The right methods should deliver against the strategic objectives.

4. Establish infrastructure – Banks will have to establish the infrastructure to help support the adoption and operation of open banking. This includes looking at open banking from the following dimensions:

a. Process – This will include aligning interface development with data protection guidelines for public APIs and building the right data sets the support the APIs. Banks will work with respective regulatory bodies (e.g., OBIC in Canada) to ensure alignment with government regulations.

b. Technology – Banks will work with fintechs will use security tokens to protect the exchange of customer information.

c. Organizational structure–Banks will have to define new strategic functions for delivering focused solutions for open banking. Establishing an organizational construct is imperative to help drive delivery and partnership with third-party providers, as this will be different from the traditional client/vendor relationship model.

d. Governance and operating model–There is a massive cultural gap between traditional financial institutions and third-party providers, which operate with more of a product and engineering mindset. To enable successful operations, banks would have to define delivery KPIs, business outcomes, and risk factors.

5. Regulatory and cyber compliance – In open banking, there is greater need for adhering to data regulations and cyber guidelines. To help protect the customer data, financial institutions will have to revisit their fraud, risk and compliance processes and procedures.

6. Re-define API strategy – Given the influence of data analytics and machine learning, financial institutions have been re-defining the API strategy to support customer experience, interoperability and scalability. To achieve efficiency at scale, they need to leverage API solutions provided by third parties.

Key Challenges with Open Banking

1. Data access & privacy – Given the increase in data vulnerabilities, data gathering done by big technology firms (e.g., Facebook and Cambridge Analytica, Google) and the increase in data thefts in the last five years, customers are concerned about sharing their financial information with multiple providers without understanding security standards and data usage guidelines.

2. Infrastructure compatibility – Financial institutions will have to revisit their existing legacy applications and strategies to ensure alignment with the third-party providers. The technology gap between legacy companies and fintechs presents an expensive hurdle to customer account aggregation.

3. Increasing cyber-attacks – Today if there’s a data breach, customers are protected by the fraud management process and insurance. But in the world of open banking, it’s unclear which party is liable if a security token between a bank and third party is compromised.

4. Fintechs will act as financial managers – In the last seven years, banks have shifted from offering financial services from traditional brick and mortar locations to mobile phones. Banks are also acquiring or partnering with fintechs to supplement those experiences. But with the rate of digital acceleration and open banking, banks will soon face increased competition from fintechs for the opportunity to manage customers’ finances. The competition will not just be among banks.

5. Customer Adoption –The adoption of open banking by customers will be driven by trust rather than convenience. Banks will have to ensure the customer information is not compromised while delivering seamless experiences.

Open banking is coming and with it comes both opportunity and challenges. But with proper planning, banks can set the foundation for transformational journeys that capitalize on new services.

Click here for Your Complete Guide to Open Banking.

Related Articles

-

![Emerging Trends in Banking]()

Five Emerging Trends in Consumer Banking

Over the next two years, the consumer banking landscape is poised for a seismic change. What do banks need to do to meet these new challenges?

-

![Promo Asset]()

When Banks Target New Customers, Personalization Is Paramount

Financial institutions can avoid wasting energy marketing to people at the wrong time by creating holistic views of potential clients.

-

![]()

The Path to Innovation Starts With the Cloud

The six doors smart financial institutes can unlock using cloud adoption as the skeleton key.