What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Travel & Hospitality

3 Ways Local and Domestic Trends Will Shape the Future of Travel

3 Ways Local and Domestic Trends Will Shape the Future of Travel

The travel industry is no stranger to upheaval and disruption, and brands are well attuned to pivoting business practices when unexpected scenarios arise. In the past 20 years, travel companies have faced complete reinvention amidst changing rules, regulations, and consumer sentiments due to 9/11, the rise of online and mobile booking, and the financial crisis.

Then came Covid-19. Public health restrictions influenced behaviors for those who did choose to travel — prioritizing family visits, balancing work and vacation, or emphasizing remote, outdoor activities — and any movement almost always occurred within their own borders.

With these trends expected to continue as travel demand increases sharply in 2021, the next few months will remain anything but business as usual and still far from a new normal. In this environment, travel brands will need to be creative, but calculated, to meet the influx of pent-up demand, enjoying the excitement of reopening while ensuring their business is running smoothly and sustainably.

“There is an opportunity now to meet new demand and build loyal relationships,” said Nick Shay, vice president of Technology & Hospitality at Publicis Sapient. “What travel brands do now and how they treat customers will fuel a longer-term recovery and help support longer goals around growth — if they do it in the right way.”

Publicis Sapient and SkiftX collaborated on this analysis of three key trends that will dominate the landscape for the next few months and into 2022, identifying how travel brands can strategically take advantage of changing traveler sentiments during recovery and optimize their operations for the future.

#1 National Travel Wins Over International Travel, at Least for Now

An uptick in leisure travel and local demand was expected to come first as the pandemic wave eased, but further waves and lockdown restrictions have made even local demand difficult to anticipate.

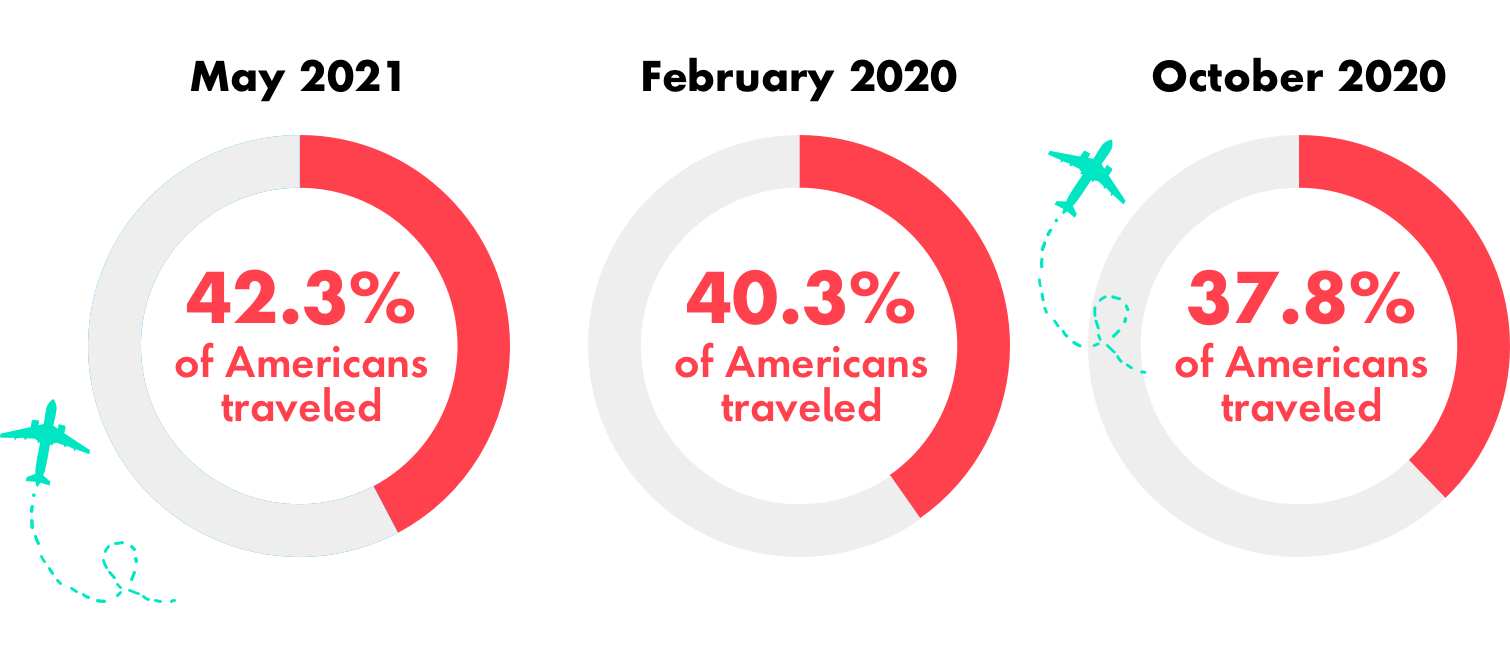

According to Skift’s latest U.S. Travel Tracker survey, 42.3 percent of Americans traveled in May 2021. This was 2 percentage points higher than in February 2020, prior to the pandemic, and 4.5 percentage points higher than October 2020, the peak of last year’s demand roller coaster.

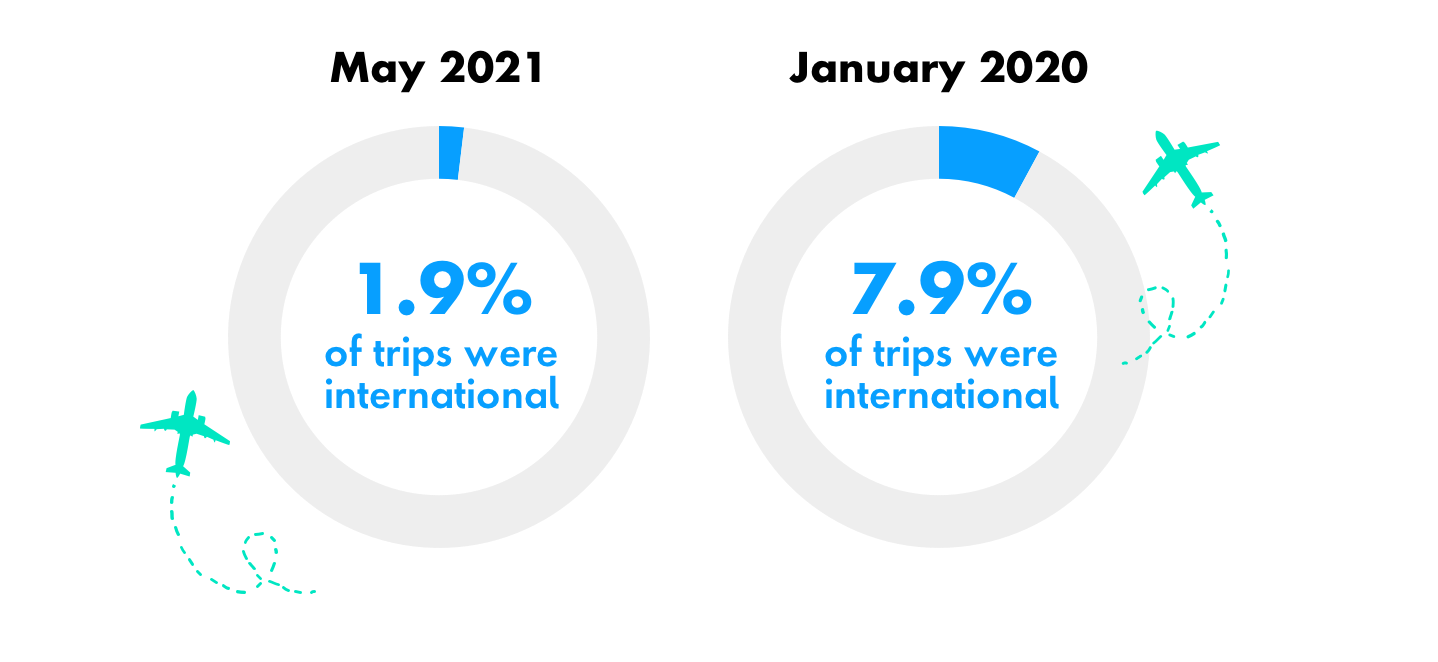

However, just 1.9 percent of all trips were international in May 2021, compared to 7.9 percent in January 2020, before news began to break about Covid-19, borders closed, and cancellations of international events began.

While international travel remains down, people are flying domestically again. According to flight-tracking website RadarBox.com, the number of daily domestic flights in China have been exceeding 2019 levels since March of this year. The first week of July saw 11,539 daily flights, compared with 10,659 daily flights for the same week in 2019.

In general, the local and domestic trend has been driven by travel restrictions, and there’s good news for destinations that have seen increased popularity: That demand is not going away. But travel is not a zero-sum game, and what is domestic today will be global in due time.

“A desire to explore, get away from it all, or switch off digitally doesn’t start and end within your own borders,” said Shay. “If you're an international traveler, you're going to be an international traveler again as soon as you are able.”

“In the short-term at least, people just want to leave their homes and their cities rather than leave their countries,” said Shay. “A change of scenery is a big demand driver right now.”

#2 Governments Will Play a Greater Role in Shaping Recovery

Over the last few months, we have started to see how different government policies and tactics have been employed to stimulate demand. A recent report by KPMG highlighted that if Australians could be convinced to spend 70 percent of their international travel budget domestically, then the tourism market could tread water through the pandemic.

Diverting overseas spend to the domestic market is not going away anytime soon, and the largest markets such as the U.S. and China have an advantage here.

According to the UN’s World Tourism Organisation (WTO), Chinese tourists spent $254.6 billion overseas in 2019, accounting for almost one-fifth of global tourism spending. By keeping its borders closed, it has diverted much of that spend locally. China has seen a record number of domestic flights this year. In March, for example, Macau welcomed the largest number of visitors from the mainland since before the pandemic.

This may be good news for domestic businesses, but not all markets can survive without overseas tourists. In these cases, the only option is to innovate their way to safely reopening borders.

For example, Thailand’s tourism industry is particularly reliant on overseas visitors, but is struggling with its own vaccination program. But by creating a sandbox on the island of Phuket and prioritizing the vaccination of its islanders, it has been able to reopen to overseas visitors who are fully vaccinated and want to stay on the island.

“This level of government intervention is something that we will see for some time to come,” Shay said. “A previously silent partner to the industry has woken up and is now key to its recovery.”

While something like this can stimulate recovery, the rapidly changing conditions of the pandemic can still bring about unsettlement. Spare a thought for the numerous businesses that have re-hired staff, only to be told they need to hold off or change the way they operate, again.

“The key for travel brands is digital flexibility and agility, because it is difficult to predict what’s coming next,” said Shay. “We’re helping our clients rapidly adapt their service models to accommodate more contactless interactions and make more use of their direct channels to provide up-to-date information, more booking options, modifications, and refunds. Safety may have been the primary driver here, but removing friction points and improving the overall experience is happening along the way.”

#3 Digital Acceleration Will Fuel Both Domestic and Overseas Travel

There is plenty of evidence that immersive experiences and virtual reality will play a role in the future of travel, and these trends picked up steam during Covid-19. While those technologies might not be popular enough to become the new normal in this upcycle, digital acceleration has already affected travel and hospitality in other ways.

According to research conducted by Publicis Sapient and Adobe, 65 percent of leaders in the dining sector are seeing significant or tremendous gaps in their current digital offerings. Now, businesses are rethinking their digital roadmaps to understand how to best transform in preparation for a fast-changing future.

In the travel space, Israel launched, scrapped, and is now contemplating reintroducing its “Green Pass” vaccine passport, all in the space of three months. The EU Digital COVID Certificate is now live in 27 member states, and other nations are trialing varying solutions to achieve the same goal of opening up travel, tourism, and hospitality. By way of contrast, it took 20 years for the widespread adoption of the biometric passport.

Shifts in the way we work brought on by the pandemic will also push new travel trends ahead. Last year, many businesses functioned successfully as their offices closed and employees worked from home. It is now likely we will see changing policies around remote work moving forward, which also presents opportunities for the industry.

Some companies — Google being one notable example — are explicitly building in “workation” policies. In an email to employees, CEO Sundar Pichai said that all employees would be allowed up to four “work-from-anywhere” weeks, which is exactly what it sounds like. “The goal here is to give everyone more flexibility around summer and holiday travel,” he wrote.

These types of policies supporting workations will lead to extended trips and additional bookings. That could mean an exotic vacation rental, or it could mean a week-long spa retreat at a nice hotel close to home — whatever work-life balance looks like to that person.

“The debates we are hearing around the use of health passports and the associated infringement of civil liberties will continue,” said Shay. “But the inconvenient truth is that digital proof of health is key to reopening travel, tourism, and hospitality services safely.”

The Upshot: How to Balance Short-Term Gains with Long-Term Goals

The intensity of the rebound, while welcomed, has caused an uneven effect in recovery. Travel companies are treading a fine line, in some cases having to resist the urge to open their doors wider amidst staff shortages, operational hurdles, and continued public health restrictions as Covid-19 rages in parts of the world and simmers, ready to boil over again, in others.

The balance in some parts lies in pragmatism, though restraint will be difficult after a terrible year for companies and consumers alike. For example, American Airlines announced route cutbacks to make sure that they could safely meet local demand in a way that gets back to a solid growth. While the decision wasn’t the most popular in the court of public opinion, predictable growth is preferable for long-term financials, and consistent service will bode better for customer satisfaction and loyalty.

Consumers recognize that the combination of high local demand and inventory and labor shortages will lead to price increases, but the fine line between economic opportunity and gouging isn’t always easy to see or communicate.

“Some companies are clearly benefiting in the short-term. And why not? They need to recover,” said Shay. “But they need to think very carefully about their pricing strategy and how they engage with their customers both now and in the future.”

Today’s travelers need more information, reassurance, booking flexibility, and fewer risks when it comes to booking travel. Brands can meet these needs by establishing more meaningful and direct relationships with customers and reducing reliance on third parties.

As Shay explained, “Sometimes you have to keep moving forward with the bigger business goals, regardless of what's happening in the short-term. The pandemic has shown that the need for a mature, yet agile, digital capability that enables new levels of customer-centricity is as relevant today as it will be for building better tomorrow.”

This content was created collaboratively by Publicis Sapient and Skift’s branded content studio, SkiftX.

Rapid Commerce in Travel

Publicis Sapient’s cloud-native accelerator allows travel & hospitality brands to consolidate products and services into a comprehensive one-stop-shop digital platform.

Related Articles

-

![]()

How to Prepare for Travel’s Impending Comeback

Learn three ways to educate travelers and four ways to prepare for—and profit from—pent-up post-pandemic travel demand.

-

![]()

Why Leisure Travelers will be the Lifeblood of Hotels in 2021

With business travel down, hotels are reinventing themselves with a focus on local leisure travelers. From enhanced health measures to adopting a CDP, unlock six ways to maximize digital capabilities to target short-distance vacationers and compete with OTAs.

-

![]()

How to Revive Your Travel Business in 2021

Learn four data-first approaches to recapturing the minds of your travelers after a year or more of unprecedented demand.