What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

Integrated Journeys Enhance the Customer Experience for Utilities

Integrated Journeys Enhance the Customer Experience for Utilities

Simon Harvey and Andy McMillan

Executive summary:

- The growth of customers seeking to connect low-carbon technology to power grids creates a significant challenge for power network utilities

- Publicis Sapient’s comparative analysis of the quote-to-install journeys across the six distribution network operators in the United Kingdom identified potential areas for transformation

- Power utility organizations should build integrated, digitized connection journeys for customers through tactical changes and strategic reinvention

With the rise of low-carbon technologies such as solar photovoltaics (PV), heat pumps, battery storage and EV charging, utilities organizations face an unprecedented challenge: the exponential growth of customers seeking to connect their equipment to power grids. How can organizations make this a frictionless, swift and high-quality customer experience?

To understand the state of customer experiences at utilities organizations and identify areas for transformation, Publicis Sapient undertook a comparative analysis of connection journeys across the six distributed network operators (DNOs) in the United Kingdom. Though based on British DNOs, this analysis identifies opportunities for utilities organizations around the world to build integrated, digitized connection journeys through tactical changes and strategic reinvention.

Customer connection in a dynamic landscape

The low-carbon technology market is rapidly changing and shows no signs of slowing. Consequently, utilities organizations must be agile and adaptable to meet operational and strategic challenges, customer expectations and regulations.

The global push toward net zero will only intensify in the coming years as nations put climate plans into action. The U.K. has pledged to reduce emissions by 80 percent between 1990 and 2050. Many of the necessary adaptations that support this goal will occur during RIIO-ED2, the U.K.’s regulatory price control period from 2023 to 2028.

Against this backdrop, customer engagement with low-carbon technology has accelerated. As an example, between 2017 and 2022, new registrations for battery electric vehicles (BEVs) in the U.K. increased by over 1,600 percent.

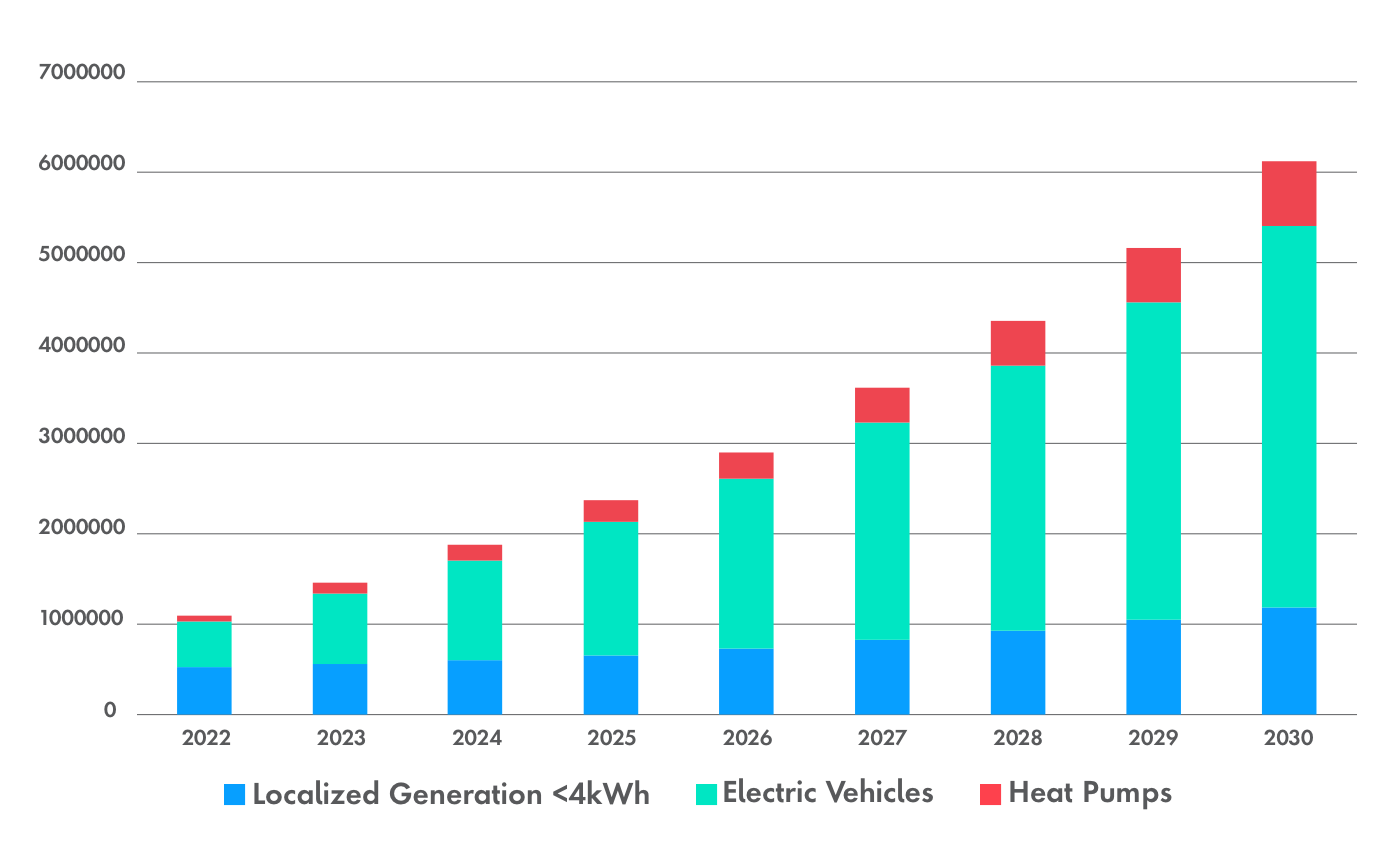

-

Source: UK Power Networks, Electric Car Scenarios—LSOA, December 15, 2021

Figure 1: Forecasted increase in low-carbon technology take up for a typical U.K. DNO

Increased customer engagement with low-carbon technology means increased customer engagement with DNOs. Customers will proactively interact with DNOs in order to make connection requests for their growing number of EV charging points and local renewable generation (solar PV, heat pumps, etc.). In the coming years, they could potentially make four times as many requests, which will challenge DNOs’ existing processes and systems.

The growth of engagement during RIIO-ED2 creates strategic and operational challenges for DNOs. They should ensure journeys are efficient and scalable. Moreover, they must continue to meet strategic objectives to satisfactorily service customers while limiting unit costs and optimizing time and resources. DNOs must also respond to a ballooning volume of requests within fixed regulatory timeframes.

These challenges only reaffirm the need for DNOs to create connection journeys that are pain-free and efficient for both customers and organizations alike. So, how can DNOs prepare to meet these challenges?

Benchmarking connection journeys

In order to assess customer journeys, Publicis Sapient conducted a comparative benchmarking analysis of a customer’s “quote-to-install” journey, when customers make a request to install and connect low-carbon technology equipment. The analysis focused on the U.K.’s six DNOs: UK Power Networks (UKPN), Scottish and Southern Electric Network, Scottish Power Energy Networks, Electricity North West, Northern Powergrid and National Grid. Experts from Publicis Sapient’s Product and Customer Experience teams evaluated each DNO, specifically focusing on:

- An assessment of the quote-to-install journey; and

- The overall experience delivered to customers.

Test-driving the customer journey

Analysts conducted a thorough review of each DNO’s “quote-to-install” journey based on the KANO model for customer satisfaction and product development. Navigating DNO websites as if they were making a connection request, analysts evaluated each step of the customer journey on a scale of one to five:

Step 1—Discovery: Customer researches hardware options, installation processes, costs, financing options and grants.

Step 2—Inquiries: Customer contacts DNO for a cost estimate and schedules a time when installers can conduct a load check to determine if the customer’s current electricity supply can support increased demand.

Step 3—Connect & Notify: Customer provides relevant information to allow the DNO to make a decision on any remedial steps that may be required before the low-carbon technology can be installed.

Step 4—Apply to Connect: Customer requires remedial work and would like to track the progress of their application.

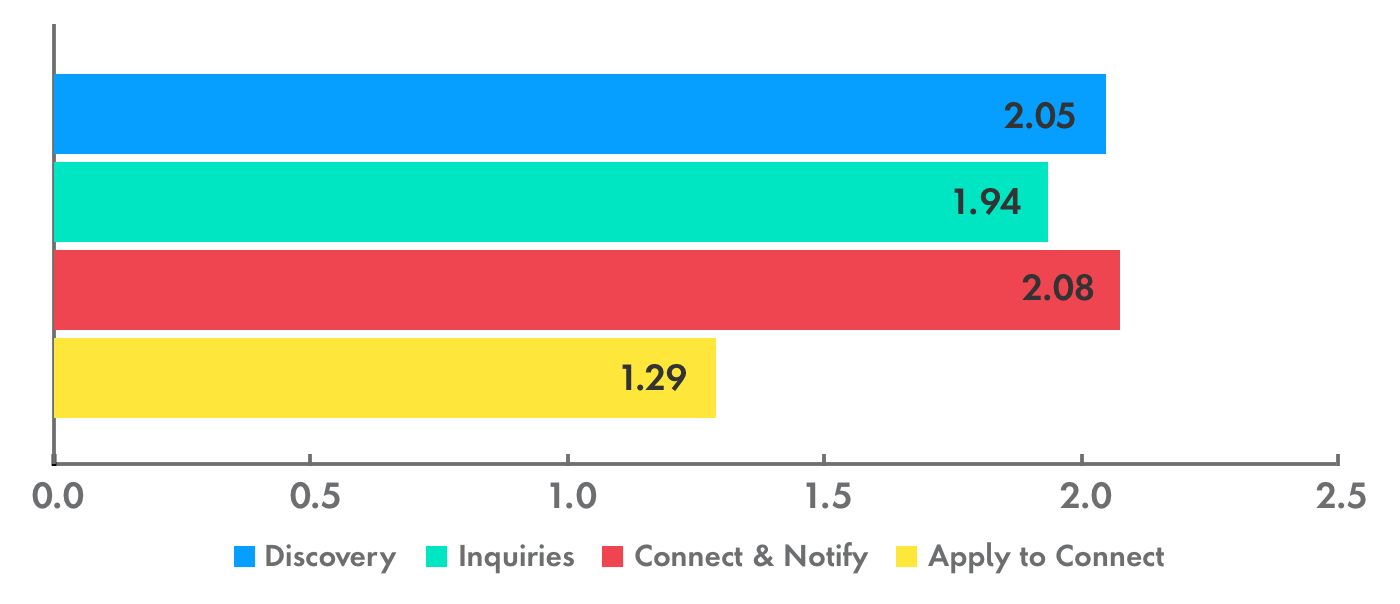

-

Figure 2: Average scores for each step in the connection journey

Though some DNOs scored higher than others—UKPN led the pack—they all received lower scores for including complicated and unclear elements on the customer journey, such as:

- Asking customers to complete forms offline and return them via email

- Requiring multiple overly specialized forms based on specific equipment

- Expecting customers to respond to questions to which they may not have answers; e.g., earthing arrangements of property, maximum demands, etc.

- Making it difficult for customers to follow up with online requests, schedule remedial work or review and pay for offers

The biggest challenge facing customers is the involvement of multiple stakeholders in the connection journey, adding complexity and uncertainty. Currently, residential customers sometimes make purchase decisions prior to researching costs and installation processes and may lack clarity about these issues when initiating a request.

Moreover, DNOs target both installers and residential customers on connection journeys, thus creating confusion over who owns which step in a journey.

These results reveal opportunities to simplify overly complicated processes. By integrating journeys, simplifying processes and prioritizing clarity, DNOs can improve customers’ connection experiences.

Measuring customer experience heuristics

The second category that analysts reviewed was the overall customer experience, based on digital best practices. The criteria that they considered were:

Intuitiveness: The digital service makes it easy to navigate, find information and complete tasks.

Contextual Messaging: The digital service guides decision-making and uses data intelligently to improve the experience.

Connected Experience: Customers can easily move across devices and channels to pick up last-accessed progress.

Support & Self-Service: Customers can self-service their needs online and easily access additional help when necessary.

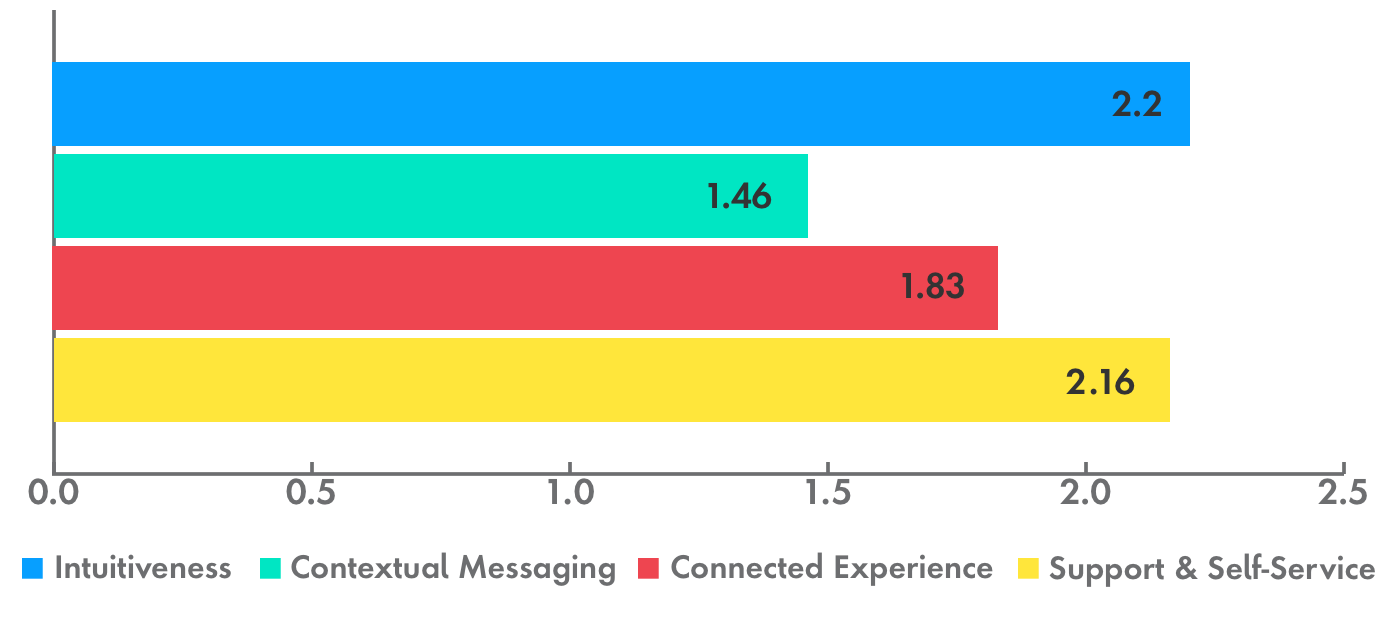

-

Figure 3: Average scores for customer experience category

Analysts scored each criterion on a scale of one to five and considered everything from the ease with which customers access online forms to the clarity of calls-to-action and the utilization of third parties to gather installation information effectively.

Again, UKPN received the highest marks. Overall, DNOs performed strongest in Intuitiveness and Support & Self-Service, since most websites exhibit a modern interface with easily accessible contact information.

However, organizations gave customers a fragmented and ambiguous experience by:

- Cataloging forms inconsistently across the website

- Lacking transparency regarding connection costs, processes and messaging

- Employing multiple touchpoints that do not meet customers’ needs

- Lacking helpful digital tools; e.g., webchat, cost calculators, etc.

- Lacking product and service recommendations

- Lacking wider ecosystem connections to adjacent services; e.g., EV manufacturers

Overall, the scores from both categories highlighted where DNOs can grow, such as by creating opportunities for personalized messaging or making service recommendations for customers. Based on the scores, analysts offered recommendations for meeting customers’ needs and building integrated journeys. Those recommendations fell under two categories:

Tactical changes: What should DNOs do immediately or in the short term to fix “hygiene factors” to ensure that journeys meet minimal customer expectations?

Strategic reinvention: How can DNOs ask and address larger questions about their role in processes and the bigger plays that they should consider?

Tactical changes provide quick fixes

The comparative analysis identified some pain points that tactical changes can alleviate. These are largely hygiene factors that are easy to identify and relatively simple to enact:

- Fix the basics: Ensure web forms utilize third-party information to accelerate the form-filling process (e.g., address lookup) and consider project accessibility for a diverse customer base.

- Digitize processes: Embrace green business processes and streamline paperwork for customers by replacing offline documents with basic web forms.

- Localize relevant FAQs: Use localized and specific FAQs alongside each stage of the process to help customers complete required information as they enter a complex space.

- Offer transparency: Provide price quotes in line with customer expectations so that they understand their options based on needs and resources.

- Follow up: Set expectations with customers to arrange the next steps according to a clearly articulated timeline.

As quick, simple fixes, tactical changes will not be enough to sustain the kind of transformation that DNOs need to meet the challenges facing them. Organizations should also consider strategic reinvention to fully integrate and digitize the customer journey.

Connect with customers more effectively with strategic reinvention

To simplify processes and enhance utility customer engagement, organizations should identify, execute and scale digital journeys by strategically reinventing their services.

Integrated journeys put customers first. DNOs should identify opportunities for bespoke journeys for either residential customers or the installers who work with them. This will optimize messaging, content and recommendations that can help customers and installers navigate the connection journey. All journeys should be simplified and fully digital to support integrated installation processes where customers and installers can schedule, manage and pay for requests in a single place.

How can DNOs build bespoke, simplified and fully digital journeys? They can follow the lead of other sectors, which set customers’ expectations for how journeys should unfold. DNOs thus have an opportunity to learn from these organizations and reinvent the utilities customer journey. Some best practices include:

DNOs can strategically reinvent the quote-to-install journey and strengthen customer-focused heuristics. By reducing touchpoints and digitizing interactions, organizations can give customers efficient, satisfying and integrated experiences while lowering unit costs and improving the time it takes to connect low-carbon technology.

Digital transformation empowers utilities and customers alike

Though this comparative analysis focused on DNOs in the U.K., its insights are relevant for utilities organizations everywhere, given the global nature of the push for net zero. The growth of low-carbon technology will escalate connection requests, and organizations should increasingly rely on scalable digital solutions that put the customer first.

DNO representatives who would like to know how their business performed in this benchmarking analysis should please get in touch to find out.

Learn which tactical changes and strategic reinventions can meet your operational challenges, customer expectations and regulations.

Related Reading

-

![]()

UK Mobile Experience Barometer Report 2021

Our research shows that many expect energy suppliers to help them manage their energy consumption. Read on for more insights.

-

![]()

How can utilities deliver a high-quality customer experience that leads to profitability?

Companies that understand the unique advantage of utilities in homes can leverage their customer connection.

-

![]()

Digital Leaders in Energy Talk Net Zero

What are your competitors planning? Where are the opportunities? Find out in our new report, featuring the opinions of 375 digital leaders at energy suppliers.