What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Beauty and grooming is all about looking good and feeling good. Whether it’s brushing up on the latest makeup fad or perfecting that daily skincare routine, beauty buyers are constantly searching for the next big thing to spice up their look and keep up with the trends.

When it comes to online shopping, beauty brands need to make sure they’re just as trendy as their buyers. According to our research, beauty and grooming makes up around 20 percent of the online market – leaving room for companies to expand the category in a big way.

So, how can brands stay en vogue? In June 2020, we surveyed 500 Millennial and Gen Z buyers to get to the bottom of what drives them to buy, how they engage with brands, and how they find new products that inspire them. Here’s what we found.

Self-care on the Regular

Beauty buyers typically have a regular routine. Replenishment is common, so they always have their go-tos on hand. However, while beauty buyers typically like to keep key staples in their cabinet, they aren’t afraid to try out new products – either from brands they’re already familiar with or have heard about before.

Getting Social

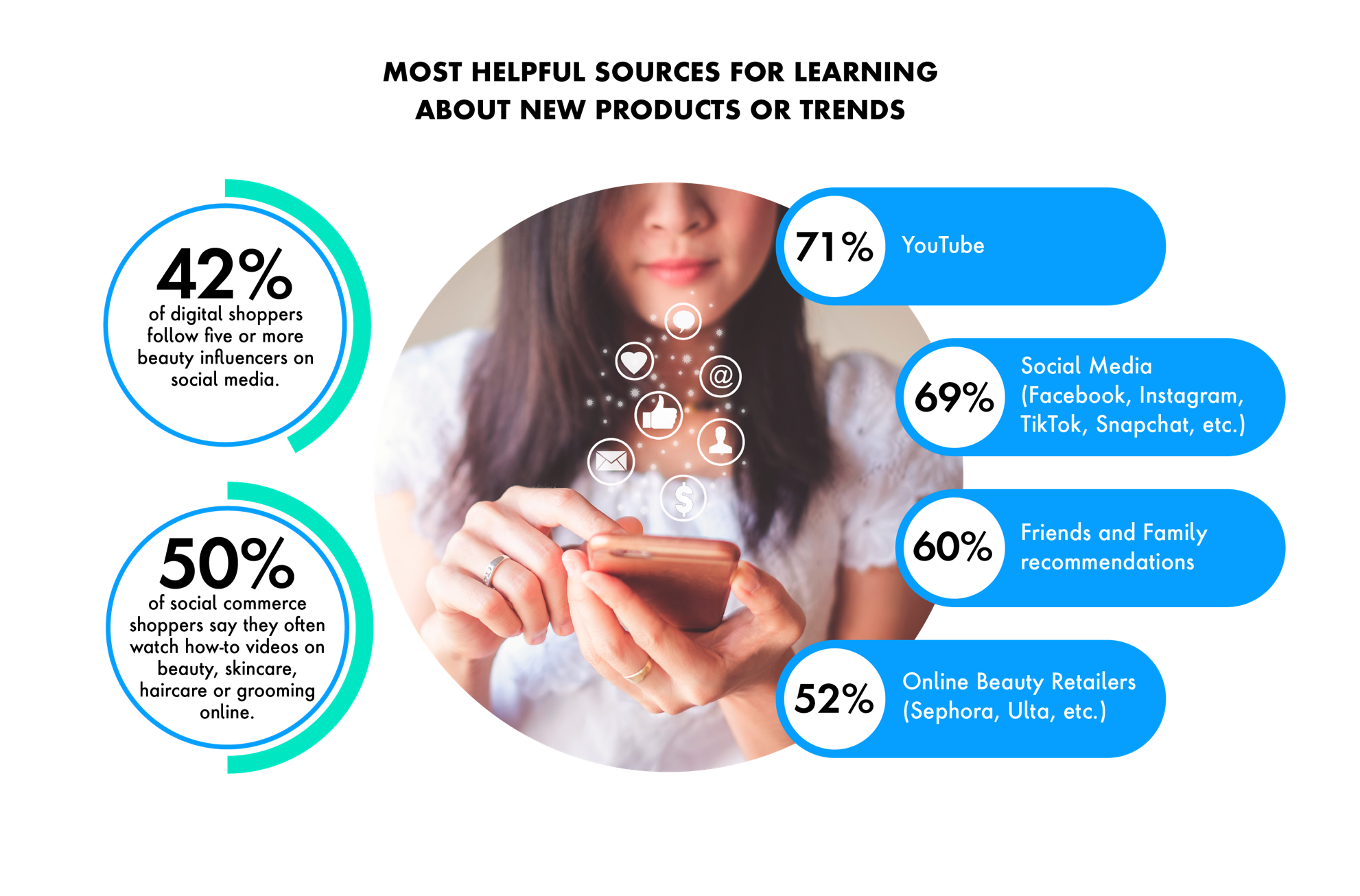

Beauty buyers like to learn about new products before buying them and turn to those they trust for recommendations on the next new thing to try. Positive reviews from friends and family, influencers, social media, and content from online retailers they frequent can go a long way. Beauty buyers also look for inspiration on social media, with how-to videos and livestreams a common resource to learn about trends and how to use products they’re considering.

A Moment for "Me"

For beauty buyers, impulse purchases are typically made during calm and relaxing moments scrolling through their favorite social media feeds. An item they’ve heard about before will pop up during browsing, sparking a moment of inspiration and curiosity that will prompt them to “click” and learn more.

Connected Commerce

Right now, beauty buyers make their impulse purchases through online marketplaces or retail e-commerce sites. Direct-to-consumer (D2C) brand sites and social commerce are also preferred channels. Benefits like loyalty points or free shipping also play a role, with shoppers inclined to add additional items to their basket in order to receive these perks.

Delightful Delivery

After an order is placed, beauty buyers wait for the moment of arrival. Unboxing moments are often associated with feelings of excitement and delight – especially if the retailer they ordered from threw in some free trial-size samples of other products they think they may also like. After they try their new products, they decide if it’s something worth adding into their routine or keep on exploring.

Turning Impulse Buys Into Lasting Brand Loyalty

Become a part of the conversation

Beauty buyers like to learn about products before they make a purchase on channels they use in everyday life. Strengthen social commerce channels by providing how-to videos, livestream events, and guides. Engage with influencers and niche content creators to expand reach and brand awareness on platforms that people trust.

Understand the buyer

Discovering and purchasing beauty products is typically a relaxing experience. Message with calm and relaxing tones and consider delivery options that surprise and delight.

Be where your customers are

Online marketplaces are typically where shoppers choose to buy. Ensure presence on these platforms is strong and products are easily discoverable. A presence on influencer and peer-to-peer marketplaces can also be a way to connect social commerce to broader audiences.

Build relationships with added perks

To continue to build the relationship, focus on incentives that encourage replenishment – making new products a part of regular routines. Recommend related products at the point of purchase, along with referral programs and rewards to encourage loyalty.

Related Reading

-

![]()

In the D2C Journey, Social Commerce Plays a Vital Role

Direct-to-consumer channels provide a path to differentiation outside of physical retail and third-party e-commerce partnerships.

-

![]()

Social Shopping and Your D2C Strategy

The role of social commerce and what it means for consumer products companies.

-

![]()

Connect With Young Consumers in the Beauty Category Through Social Commerce

We take a look inside this new shopping mall that is our social media feeds and how it can be harnessed to connect beauty brands to young consumers.