What issue can we solve for you?

Type in your prompt above or try one of these suggestions

Suggested Prompt

Energy & Commodities

Energy Retail’s Future: Innovation Drives Success

Energy Retail’s Future: Innovation Drives Success

Work out where to play and how to win

Energy retailers face a reshaped landscape, and they must embrace change to define the playing field on which they can compete. These are five things energy retailers can do to prosper.

Managing disruptive times

In 2020 alone, energy retailers have had to respond to government intervention, new entrants without legacy issues and a significant drop in consumer demand. These challenges have compounded years of decline and have set the pretext for the energy landscape to be radically redefined. They can meet evolving demand that is calling for more renewable energy options and reconsider cost, technology and mindset.

Energy organizations, whether incumbents or new entrants, can deploy technology to enhance customer service options amid the pandemic.

Three Innovation Horizons

To tackle customer and business challenges, energy retailers have a set of investing options across three innovation horizons.

Sustaining innovation: Digitizing today’s business

Focuses on existing business and customer base – with the aim to make incremental improvements by using new digital assets and capabilities.

Evolutionary innovation: New sources of growth

Uses adjacent markets to create growth. An example is how retailers are working with the automotive industry to drive adoption of EV vehicles.

Disruptive innovation: New forms of competition

Enters new markets to create competition. An example is retailers looking at ways to balance the grid and pay customers to consume energy in times of excess supply.

Using these horizons as frames, here are five areas energy retailers can innovate to create value:

Every energy retailer needs to transform the cost base. According to costs analyses conducted by Publicis Sapient, the best in class are low-cost retailers that can reduce their cost base by between 50 to 75 percent. The key enablers to cut costs are reducing unnecessary contact, driving digital self-service, moving to cloud Saas base technologies and adopting agile and product mindsets.

Energy retailers have two choices about how they go to market. Do they become the branded player? In this case, the aim is to own the customer relationship, providing opportunities to cross-sell and upsell products and services. Or do they want to become the value player? In this instance, the aim is to deliver the lowest price to customers for their energy.

- The branded player

Seeks to differentiate on service, customer experience and brand.

- The value player

Uses auto-switching services and the platform that provides the largest and widest reach to customers.

Energy retailers can look beyond the traditional industry and deliver against a new breed of standards. Customers expect regular improvements to the experience, they expect self-service as standard and they expect a supplier to build trust, be emphatic and deliver seamless experiences. Brands such as Monzo, Octopus and First Direct who differentiate this way will become the destination for consumers, who will buy and manage their energy needs.

There are two routes in the decision-making process – drive volume or create a relationship with customers. The energy company can build a relationship with their customer through branding. If the energy company wants to drive volume and win customers over by providing the cheapest price, then it can focus on a “no frills” experience, selling energy through price comparison websites.

Retailers can provide a guaranteed outcome around efficiency, comfort and care by building capabilities in home thermodynamics and design ecosystems of hardware, software, financing and maintenance to democratize access for the mass market.

Energy retailers who tap into adjacent markets will have to develop a platform mindset. These retailers will most likely not sell energy in the future but will focus on delivering a new breed of service.

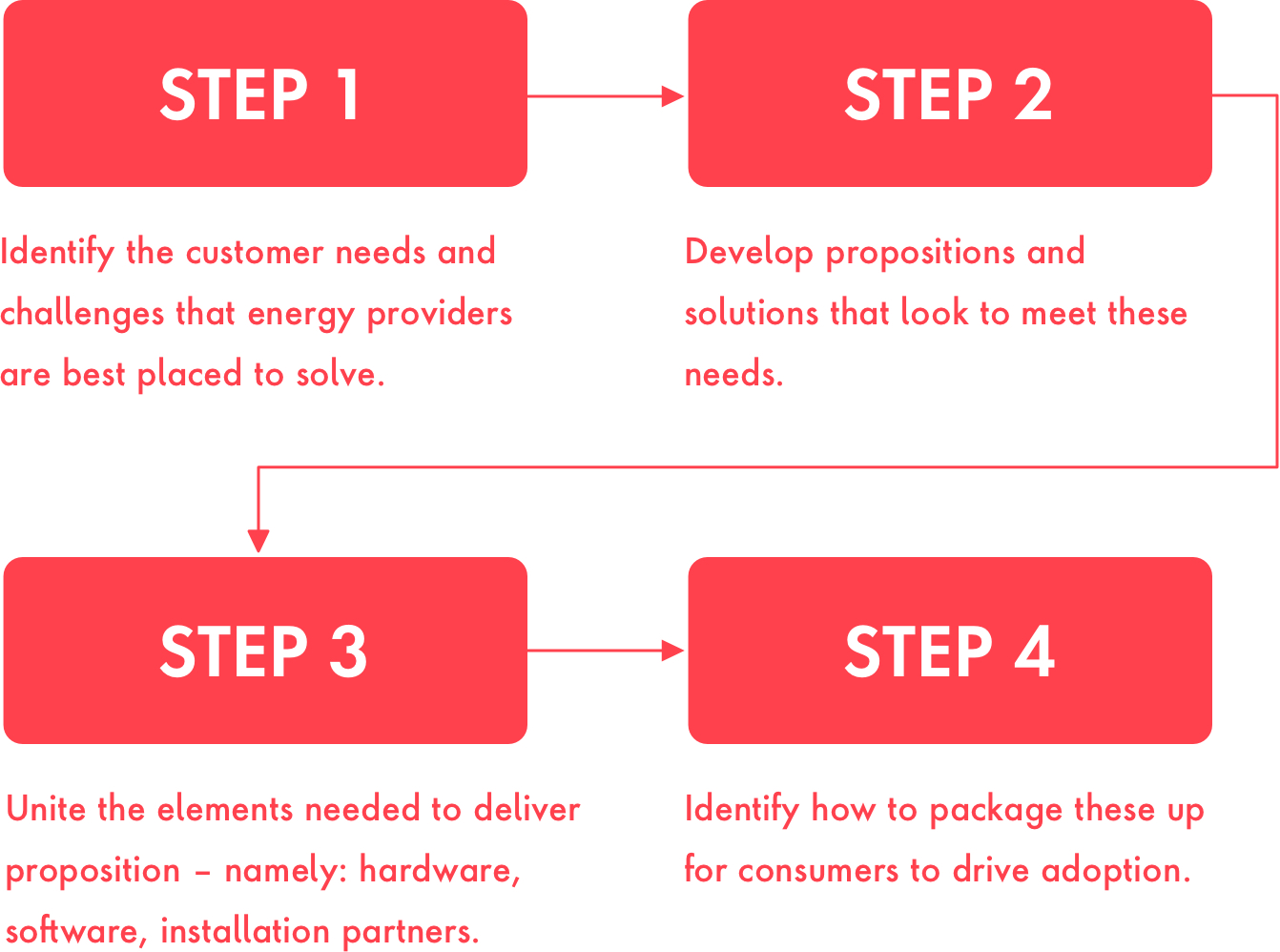

Retailers can take four steps to become platform-centric:

As the adoption of electric vehicles (EVs) grows, energy providers will play a bigger role outside the home. Data in the latest Publicis Sapient DLI survey reveals that home energy providers are vying for a top place incharging stations, with 30 percent of respondents saying they would consider their home energy provider to charge their EV battery. Retailers can offer a unified charging ecosystem including home charging and installation of charging points. Energy companies can enable access to charging on the road. This will need to come in the form of partnerships – but energy retailers must work toward solidifying partnerships.

Along with being responsible for expanding charging infrastructure, retailers will need to develop additional value-adding services. For example, BT Wi-fi allows customers to access millions of hotspots on the go, enabling users to access their 4G and 5G data allowances at home, on the move or while traveling abroad.

Here are four activities energy retailers can take to service EV customers:

-

![]()

ONE

Educate to expand the market

Energy retailers can develop personalized insights for vehicle buyers to make the switch to driving EVs.

-

![]()

TWO

Integrate the purchase journey

EVs require supporting products and services. For energy retailers it means becoming a distribution channel for power users.

-

![]()

THREE

Create a unified charging ecosystem

Customers want to charge their vehicles on the road as easily as they do at home. Energy retailers should form partnerships with each other and with third parties in order to create energy tariffs and services that enable a seamless charging experience for drivers.

-

![]()

FOUR

Redeploy resources

Energy retailers must assess how they can leverage their current capabilities to gain a competitive edge in the EV market. They can install charging points or service EVs at the roadside, and car dealerships can become a channel for selling tailored EV energy packages.

Though more dominant in Europe than in the US, the idea of “prosumption” involves production and consumption rather than focusing solely on production or consumption. Customers will not only have the choice in where they source their energy, but they can also sell excess energy back to the grid.

Arguably the biggest disruptive opportunity to change the landscape is the relationship energy retailers have with their customers – and the relationship customers have with their retailers.

Energy retailers can drive this shift in terms of enabling a peer-to-peer marketplace and by lowering the barrier to entry. The consumer electronics industry is a source of inspirationin how this works. Smart phones and in-home TV platforms can cost in excess of thousands of dollars. But for the most, consumers can get access to these products from as little as £30-40/month in the UK. These multi-year subscriptions approaches consist of leased hardware, access to software platforms, product maintenance and servicing, as well as access to third-party marketplaces (content and/or providers).

How to Win: implications for addressing industry challenges

Energy retailers can tap into key guiding principles to address industry specific challenges, based on what area they wish to play to win.

For those retailers who want to address their legacy business, it will become important to drive self-service by addressing today’s customer pain points. This requires shifting core CRM and billing platform to native cloud in order to significantly reduce costs.

For retailers who want to enter into adjacent markets, it will be essential to re-imagine customer journeys to achieve the new normal of exceptional customer experiences. Likewise, a significant shift in ways of working will be essential to place the customer at the center of the business.

For retailers who want to capture and create new markets, it will be about identifying and addressing unique customer needs and exploring new business models and ways of working to unlock value.