Telecommunications, Media & Technology

How Generative AI Will Change Payment Technology

One of the most exciting developments in the payment industry is the integration of Artificial Intelligence (AI) into payment technology. The dynamic response of fintechs and emerging players to technology advancements has not only pushed traditional players to adopt AI, but has also fostered an environment with fewer cumbersome legacy systems in the payments sector. This distinguishes it from the traditional financial services landscape.

The financial sector is exploring embedded finance, super apps, the metaverse, peer-to-peer wallets, cryptocurrency payments, buy now, pay later (BNPL) and more. Payments are being made at greater speed and with increased versatility. With generative AI, what are the payment possibilities of the future? How will generative AI redefine interactions within payment systems? Here is how generative AI will transform ways of doing business in the payment tech and payments industry.

Generative AI will have a revolutionary influence on payment platforms

At present, the pace of generative AI adoption is faster than internet startups, with ChatGPT reaching 100 million users within two months. According to research by Publicis Sapient, the majority (87 percent) of consumers who have used generative AI are excited about what generative AI can bring to their shopping experience. They expect brands to use the technology to improve overall customer experience.

Generative AI is emerging as a true game changer within the realm of payments. As organizations increasingly recognize its potential and seek to keep pace with the market, can payment tech companies navigate through all the hype surrounding this emerging technology and capitalize on the right opportunities?

Spearheading this transformation are AI-driven payment platforms, which harness complex algorithms to not only revolutionize but optimize payment technology. For example, super apps—multifunctional, all-in-one digital platforms—can integrate a wide range of services delivered directly to consumer smart phones. In this space, Alipay has transformed the way people make cashless payments.

But AI's impact transcends transaction processing—with generative AI, opportunities for innovation extend into fraud prevention, customer support and overall payment experience enhancement. For instance, organizations employ generative AI to analyze user purchase histories and preferences, enabling seamless, personalized payment experiences.

The imperative to strategically employ generative AI

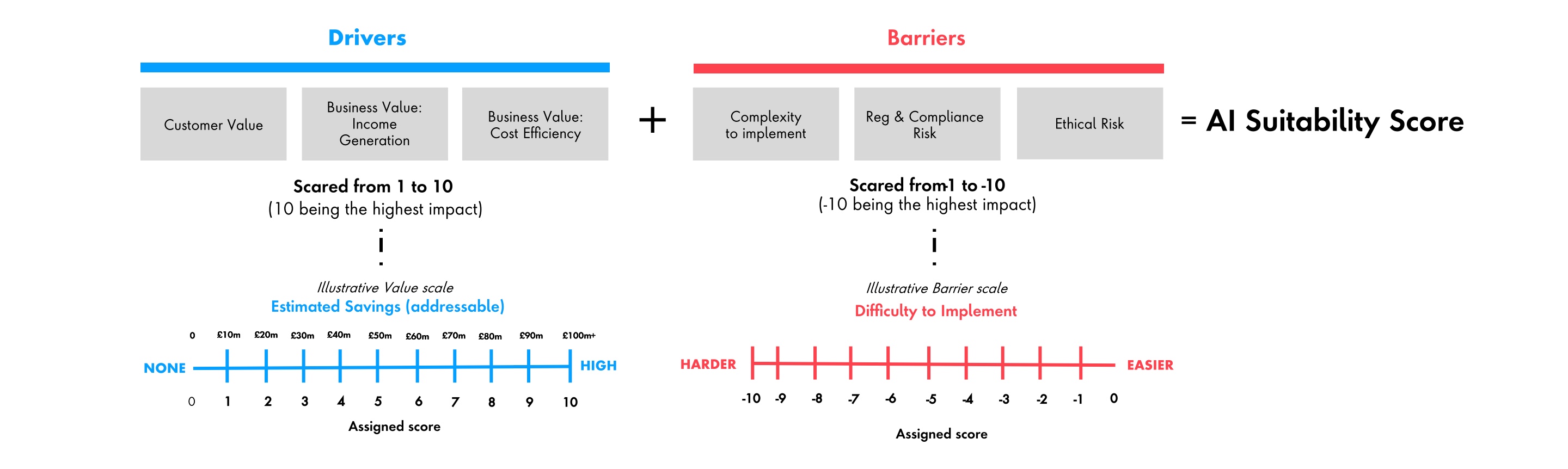

For businesses to flourish, it is imperative to strategically employ generative AI in the following three key business dimensions: